Simplicity Of Elliott Wave

As we all know Elliot Wave is one accurate analysis if we know to read each wave with the right value, here sample exercise below on how to use the Elliott wave theory with the right method.

Exercise 1

At one moment you are faced with a pattern that seems to have emerged from wave 1 and wave 2, until here the pattern that has been confirmed correct wave is a wave pattern characterized by the emergence of the correction wave (wave 2).

But wait, is this true wave 2? It is still too early to ensure this is a wave 2. For that, some things that can be used as an additional consideration are:

* The nature of wave 2 is not likely to fall below the initial wave 1.

* Usually waves 2 and 4, will bounce at the 50% Fibonacci level (retracement).

Also Read Article :

So now we draw Fibonacci lines along the wave 1. Look at the picture below, the price has moved to a new level of Fibo retrace 50%, so around that price is a prediction/signal that will be forwarded to wave pattern 3, meaning it’s time to get ready to buy.

If you open a position, certainly the beginning of wave 1 position, is a realistic value to be used as a Stop Loss. Why? if prices continue to move down, it means we are wrong predictions, and identify if wave 1 is also wrong.

Fine, let’s say you do not miss the opportunity, you open Buy after a few moments.

Yes … Hoolla, you make predictions and act properly. Which is formed from the combined signal wave pattern 1 2 (Ellliott) + Fibonacci in confirmation with wave 3. This means profit for you.

Also Read Article :

Well let’s try again with another example:

Exercise 2

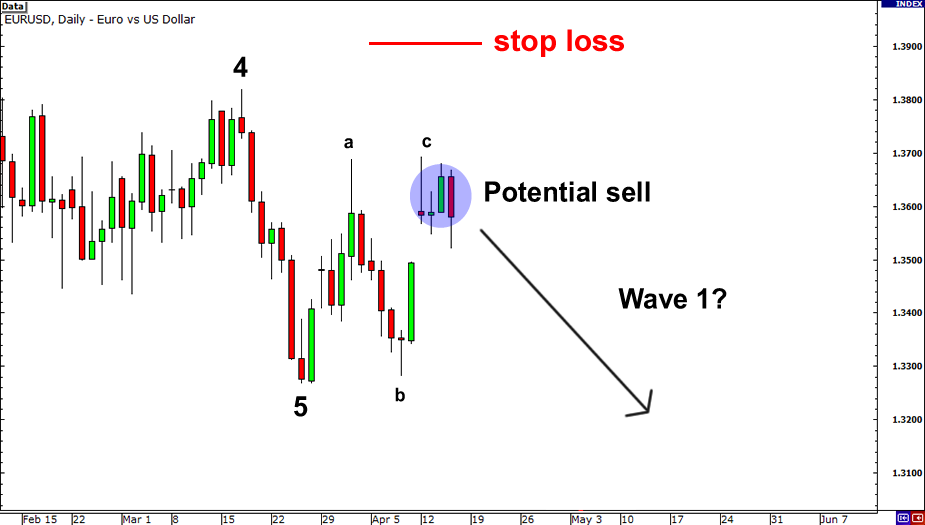

At one moment you see a downtrend and pattern of 1-3-5 Elliot has been formed and now followed in the correction phase of the ABC. From the picture below looks, there was a pattern flat in the correction.

So there will be a sell signal / down or turn up / buy. Which is the best yes? Because the initial trend is down then instinct says just follow the trend (trend Following) so prepare to open sell.

Also Read Article :

But as a smart trader, you should still always think logically that guesses could be wrong. For that let us wisely manage their stop loss.

If you buy the position of stop loss is the most relevant results in position when the end of Wave 5

If you sell the position of stop loss is at the end of wave 4. Reasonable isn’t it …?

Because we follow the trend, so we Sell, and put stop loss in the final position of wave 4.

Let’s see what happens, and how the subsequent price moves.

Attention

Yes. Congratulations, once again we understand about using Elliott wave theory and the trend so your pips will be increasing itself. And don’t forget to learn candlestick basics and price action setups as reversal points on each wave.

Happy Pips by practicing this great and simple Elliott-wave theory in some recommended forex brokers on the right sidebar.