Forex Basics

Ever wonder what all those numbers mean at your broker’s website? Don’t worry, we will explain everything in grueling detail for the very beginner. Let’s begin to learn more about forex basics.

Ever wonder what all those numbers mean at your broker’s website? Don’t worry, we will explain everything in grueling detail for the very beginner. Let’s begin to learn more about forex basics.

Instrument And Variable

What is a currency pair?

Unlike stocks, foreign exchange allows one to buy one currency in exchange for another. The currency pair indicates which currency you are buying and which one you are selling. These are the four major currency pairs and are the ones you should begin trading with:

EUR/USD

GBP/USD

USD/CHF

USD/JPY

These are the most heavily traded currency pairs; therefore, they are the most liquid and typically have the lowest spreads.

The ABC Trading Strategy in Forex: Trading Within Liquidity Zones

The ABC trading strategy is a popular method used by forex traders to identify potential trend reversals and capture favorable entry points. When combined with trading within liquidity zones, it can offer traders additional insights into market dynamics and improve the accuracy of their trading decisions.

Understanding the ABC Trading Strategy

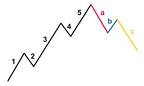

The ABC trading strategy is based on the concept of identifying specific price patterns that signal potential trend reversals. It consists of three main components: the A leg, the B leg, and the C leg.

- A Leg: The initial price move, often representing the end of an existing trend.

- B Leg: The corrective phase, where the price retraces part of the A leg’s move.

- C Leg: The final phase, where the price resumes its original direction, indicating a potential trend reversal.

Applying the ABC Trading Strategy Within Liquidity Zones

When trading within liquidity zones, traders focus on areas of the market where there is a high concentration of buy and sell orders, resulting in increased liquidity. This approach can help traders identify key levels where price reversals are likely to occur, enhancing the effectiveness of the ABC trading strategy.

Understanding Liquidity Zones

Liquidity zones in the forex market refer to areas where there is a significant concentration of buy and sell orders, leading to increased trading activity and smoother price movements. These zones often coincide with important support and resistance levels.

- Liquidity zones are significant in trading as they often act as barriers to price movements, providing traders with valuable information about potential entry and exit points.

Identifying and Analyzing Liquidity Zones

Support and Resistance Levels

- Support and resistance levels are key elements of liquidity zones. These levels represent areas where the price has historically struggled to move below (support) or above (resistance).

Volume Analysis

- Analyzing trading volume within liquidity zones can provide insight into the strength of support or resistance. Increased volume at these levels can signal the presence of significant buying or selling interest.

Price Action

- Observing price action within liquidity zones can help traders gauge market sentiment and the potential for trend reversals.

Implementing the ABC Trading Strategy Within Liquidity Zones

Step-by-Step Instructions

- Identify Liquidity Zones: Use technical analysis tools to identify key support and resistance levels that coincide with liquidity zones.

- Confirm the ABC Pattern: Look for the completion of the A and B legs, and anticipate the potential start of the C leg within the liquidity zone.

- Entry and Exit Points: Plan entry and exit points based on the completion of the C leg and the confirmation of a trend reversal within the liquidity zone.

- Risk Management: Set stop-loss orders to manage potential losses and protect profits. Consider the risk-reward ratio before entering a trade.

- Trade Execution: Execute trades based on the confirmation of the ABC pattern within the identified liquidity zone.

Advantages and Limitations of the ABC Trading Strategy in Liquidity Zones

Advantages

- Increased probability of identifying potential trend reversals within liquidity zones.

- Enhanced precision in identifying entry and exit points.

Limitations

- False signals can occur, leading to potential losses if not managed effectively.

- Reliance on historical price patterns may not always accurately predict future market movements.

Real-Life Examples and Case Studies

Example 1:

- Identifying a liquidity zone around a major support level.

- Observing the completion of the ABC pattern within the liquidity zone.

- Executing a successful trade as the price reverses at the liquidity zone.

Example 2:

- Identifying a liquidity zone around a significant resistance level.

- Recognizing the completion of the ABC pattern within the liquidity zone.

- Experiencing a false signal as the price fails to reverse, leading to a small loss.

Tips and Best Practices

- Combine Multiple Indicators: Use a combination of technical indicators and price action analysis to validate potential trade opportunities.

- Practice Patience: Wait for clear signals and avoid forcing trades within liquidity zones.

- Continuous Learning: Stay informed about market developments and continuously refine your understanding of liquidity zones and the ABC trading strategy.

By integrating the ABC trading strategy with a focus on liquidity zones, traders can enhance their ability to identify high-probability trade setups and effectively manage risk within the dynamic forex market. Continual practice, observation, and adaptation are essential for mastering this strategy and achieving long-term success in forex trading.

By integrating the ABC trading strategy with a focus on liquidity zones, traders can enhance their ability to identify high-probability trade setups and effectively manage risk within the dynamic forex market. Continual practice, observation, and adaptation are essential for mastering this strategy and achieving long-term success in forex trading.

A low spread is vital to your success. A high spread takes out a big chunk of your profits every trade.

Summary

You have learned the basic terms and definitions of foreign exchange. You can now read THE CANDLESTICK TRADING BIBLE and understand the numbers that appear on any forex website. Learning the forex basics is only the start. Continue to build on your knowledge to succeed in this game.