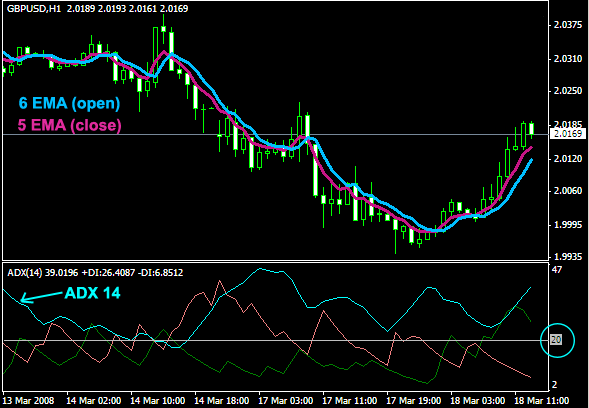

Average Directional Index Trading Analyses

The average directional index, or ADX for short, is another example of an oscillator. It fluctuates from 0 to 100, with readings below 20 indicating a weak trend and readings above 50 signaling a strong trend.

Unlike the stochastic, ADX doesn’t determine whether the trend is bullish or bearish. Rather, it merely measures the strength of the current trend. Because of that, ADX is typically used to identify whether the market is ranging or starting a new trend.

Average Directional Index Trading Setups

Take a look at these neat charts we’ve pulled up:

In this first example, ADX lingered below 20 from late September until early December. As you can see from the chart, EUR/CHF was stuck inside a range during that time. Beginning in January though, ADX started to climb above 50, signaling that a strong trend could be waiting in the wings.

And would you look at that! EUR/CHF broke below the bottom of the range and went on a strong downtrend. Ooh, that would be around 400 pips in the bag.

Book it, baby!

Now, let’s look at this next example:

Just like in our first example, ADX hovered below 20 for quite a while. At that time, EUR/CHF was also ranging. Soon enough, ADX rose above 50 and EUR/CHF broke above the top of its range.

Tada!

A strong uptrend took place. That would be 300 pips, signed, sealed, and delivered!

Looks simple enough, right?

If there’s one problem with using ADX, it’s that it doesn’t exactly tell you whether it’s a buy or a sell. What it does tell you is whether it’d be okay to jump into an ongoing trend or not.

Once ADX starts dropping below 50 again, it could mean that the uptrend or downtrend is starting to weaken and that it might be a good time to lock in profits.

How to Trade Using ADX

One way to trade using ADX is to wait for breakouts first before deciding to go long or short. ADX can be used as confirmation of whether the pair could continue in its current trend or not.

Another way is to combine ADX with another indicator, particularly one that identifies whether the pair is headed downward or upwards.

The average Directional Index can also be used to determine when one should close a trade early.

For instance, when the Average Directional Index starts to slide below 50, it indicates that the current trend is losing steam. From then, the pair could move sideways, so you might want to lock in those pips before that happens.

Average Directional Index Scalping Forex Trading Strategy

Source: babypips