Definition Of Support Resistance

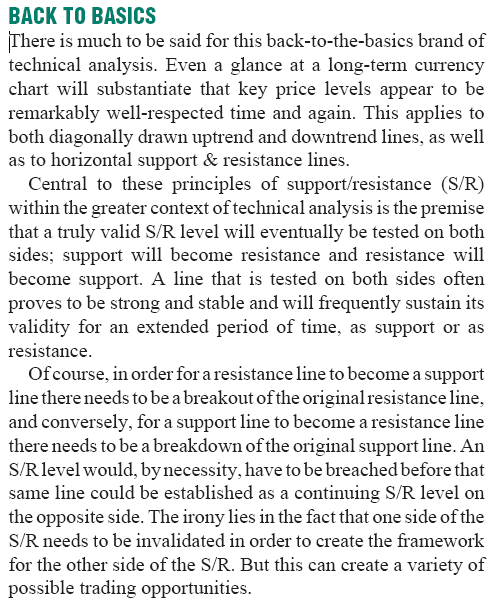

The beauty of support and resistance lies in its simplicity. Its validity has been tested over and over again throughout history and remains one of the most widely used analysis tools of all time. It works because it is based on simple crowd psychology. And as much as we don’t like to admit it, we are the same irrational creatures we were a few hundred years ago.

If you could predict where the market is heading, you would be a millionaire. Unfortunately, no one has developed an indicator that will predict the future. Many indicators have been created that will give you a probable direction of the market, and among them, the concept of support and resistance has risen to the top of the pile.

Example Support Resistance Levels

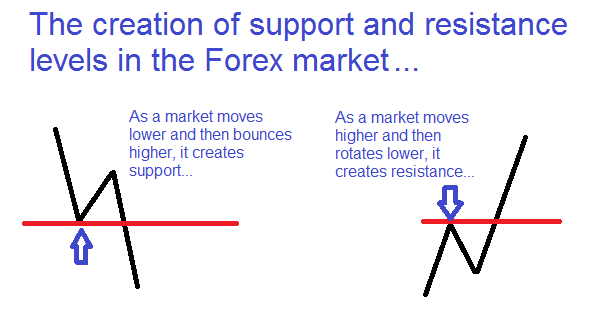

Support is a price level where the market has difficulty dipping below it because the demand is sufficiently high at that level. Support levels are always on or below the current price. In other words, the support line is where the price stops falling.

Here is an example from support levels :

Resistance is the opposite of support. It is a price level where the market has difficulty surpassing that price level because the selling forces are strong at that price. Resistance levels are always on or above the current price. It is where the price level stops rising.

Here is an example from resistance levels :

Strength of the Support and Resistance Line

Each time the price of the currency pair touches the support or resistance levels, it strengthens its validity. A psychological barrier exists at that price which will prevent it from dipping below the support line or crossing over the resistance areas.

The support and resistance are given greater weight if they happen to lie on an even number. The psychological pressures are greater at these even numbers.

How We Trade Using Support Resistance Charts?

Our trading strategy recommendation for using these support resistance levels is very simple. We can use this accurate trading system with consistency if we filter this support resistance level with economic indicators. So, this support resistance trading strategy still needs to be filtered with fundamental analysis and candlestick basics knowledge.

We only looked at several price levels that have been tested many times but failed. In my opinion, at least has been tested at least three times with failed than break out. We can look at these tested levels in an hour time frame and if we find these strong support resistance levels we can put a horizontal line at these levels and mark it as strong s/r from one one-hour time frame. And if price action is rejected at these strong s/r levels and confirmed with reversal candlestick patterns by seeing on the smaller time frame, it is confirmed as our valid signal entry and take profit levels can be located at a strong support resistance level based on a four-hour time frame.

We only looked at several price levels that have been tested many times but failed. In my opinion, at least has been tested at least three times with failed than break out. We can look at these tested levels in an hour time frame and if we find these strong support resistance levels we can put a horizontal line at these levels and mark it as strong s/r from one one-hour time frame. And if price action is rejected at these strong s/r levels and confirmed with reversal candlestick patterns by seeing on the smaller time frame, it is confirmed as our valid signal entry and take profit levels can be located at a strong support resistance level based on a four-hour time frame.

We can use this accurate support resistance trading strategy without any support resistance indicators. So, just look left from the current running price to see a strong support resistance level that has been tested at least three times. This is our support resistance strategy tested and works.

Also Read Article :

My tips about using a support resistance forex trading system are to use the highest wick body candle as the looking resistance level and the lowest wick body candle as the looking support level.

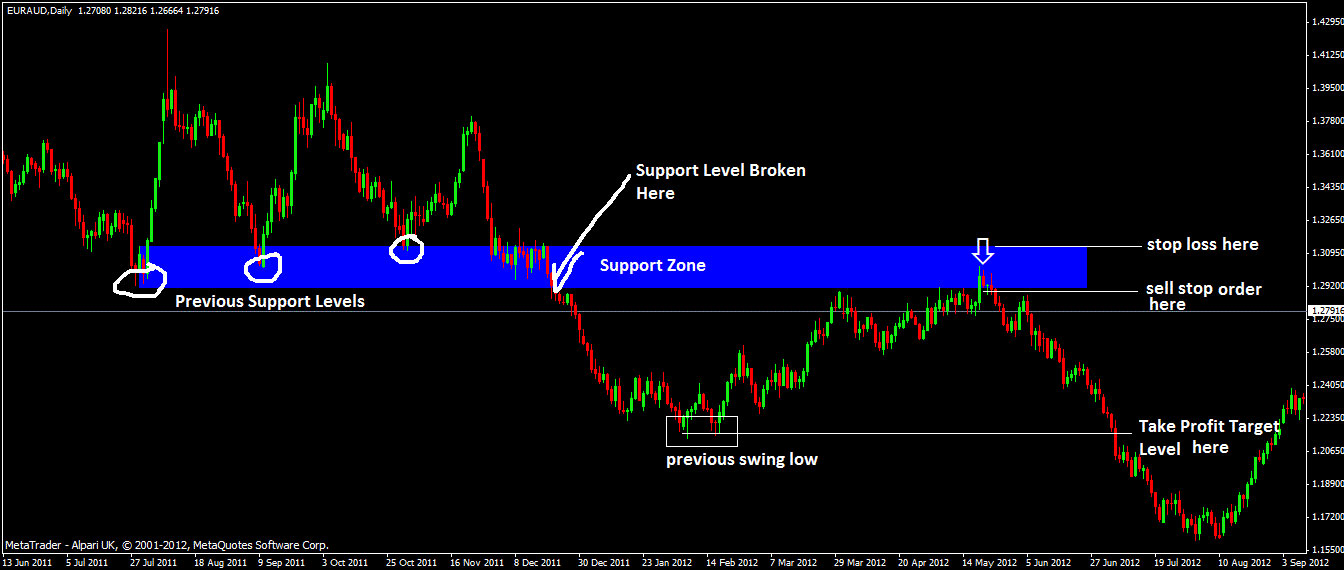

Here again, is an example of forex strong signals from using support resistance trading strategy below :

Don’t Forget the Stop losing!

Everything we have been discussing thus far is based on history and probabilities. The price can easily dip below the support levels, and conversely, it can easily break through the resistance levels. You are a smart one and already know how to protect yourself from a disaster. You guessed it. Always have a stop-loss strategy.

There is no excuse not to include a stop loss with your order. Forex is a game of percentages. You want to minimize your losses if the market does not go your way, and let your winners define your performance. It doesn’t matter if you lose 10 times more than you win, as long as your winning trades profit more than your losing trades in the long run.

Put this knowledge into Action

So how does all this apply to you? Well, you should always be on the lookout for support and resistance. It is a surprisingly simple, yet effective way to trade. Buy near the support lines, and sell near the resistance lines. Lots of traders have successful careers based on this simple methodology. Here is some reading about support resistance forex references and this support resistance template for mt4. Try it out on a practice account and trading on our tested and professional forex brokers’ recommendations and see how you can profit from support and resistance forex trading strategy.

Advanced Market Structure Course (Full Tutorial)

Market Structure Tips In Forex

Which Best Pullback We Trade-In

Learn and practice how to read candlestick reversal patterns as our entry kill zone in London Session combined with multi-timeframe analysis to get sharp entry forex trading signals. Performance can be seen here.