How To Invest In Forex Easily

The forex (foreign exchange) market, which trades in international currencies, is the largest and most active market in the world. In 2006, trades averaged over $1.9 trillion per day. Due to extreme liquidity, it can be difficult for small traders to get in on the action. However, retail traders can participate through mutual funds.

The forex (foreign exchange) market, which trades in international currencies, is the largest and most active market in the world. In 2006, trades averaged over $1.9 trillion per day. Due to extreme liquidity, it can be difficult for small traders to get in on the action. However, retail traders can participate through mutual funds.

1. Learn how to read a forex quote. This is a ratio of one currency to another. USD/EUR is the price of a US dollar as expressed in Euros. The currency listed first is the base currency (usually the stronger currency at the time of the quote) and is given a value of 1. The second currency is the counter currency and derives its value to the base. If the USD/EUR quote is 1.21, that means 1 US Dollar has the same value as 1.21 Euros.

2. Understand the definitions of pip and spread. Prices in foreign exchange are expressed in pips–percentage in points. The pip is the number in the fourth place from the decimal point or 1/100th of 1 percent. If USD/EUR is 1.1300/1.1304, there is a 4-pip spread between the two currencies.

3. Learn about bid and ask. The “bid” is the selling price for the base currency and the “ask” is the price to buy the base currency. Both transactions are done simultaneously.

4. Learn about leverage and margin. Leverage is the ability to trade without having to put up the entire amount of the transaction. Margin is the minimum amount required to participate in a trade, usually 1 to 2 percent. The forex market allows higher leverage because major currencies are less volatile than stocks; higher leverage also allows amplification of both profit and loss. Because of this, the forex market is more volatile than the stock market.

5. Select a mutual fund. Unlike the stock market, the forex market has tiers of access. An individual investor would find it difficult to gain significant access. Furthermore, in a 24-hour market, it is difficult for individuals to keep track of investments with any degree of vigilance. Most retail investors work through specialized mutual funds. Search online for managed funds to choose from. Your choice will depend on your desired level of risk, the fund’s past performance, the fee structure, and restrictions on deposits and withdrawals.

For one of our recommended forex-managed accounts, you can contact our managed accounts trader manager, and a minimum deposit of $1000 leverage 1:500 or more. Brokers one of the list below.

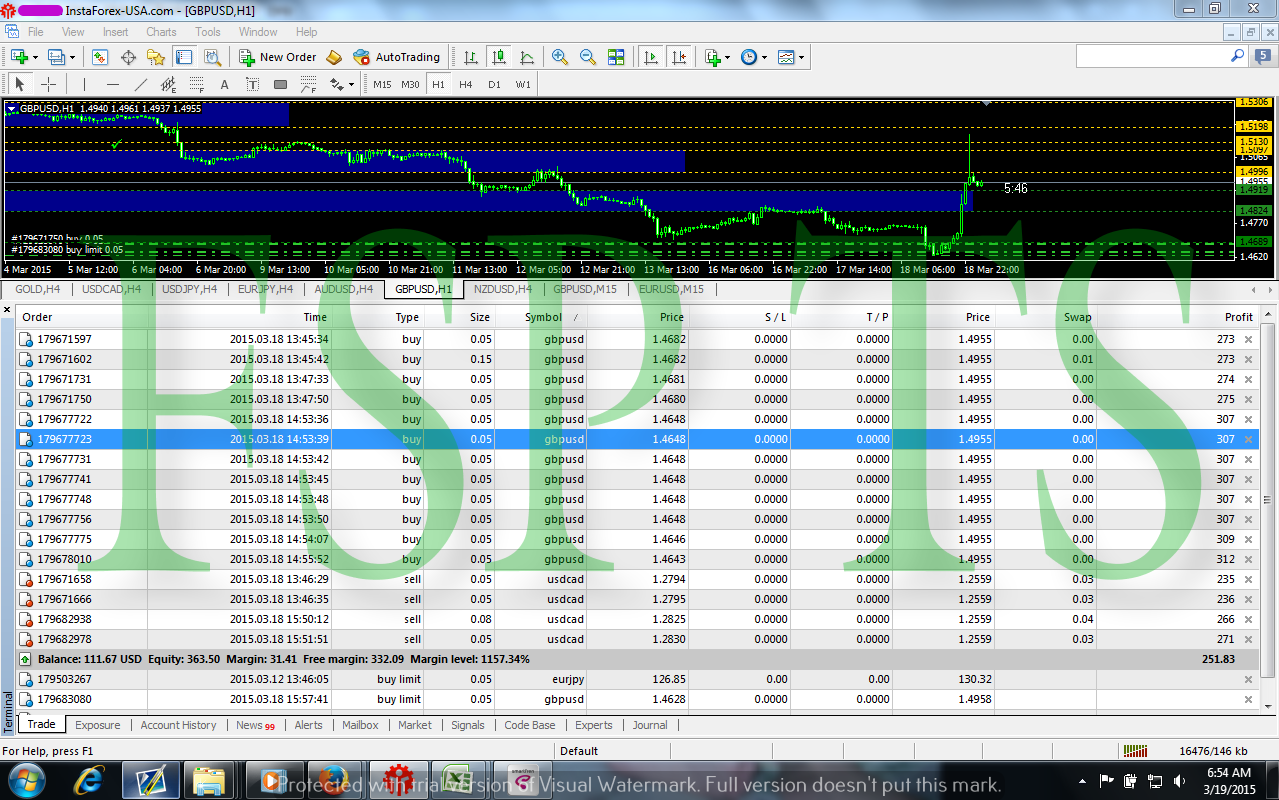

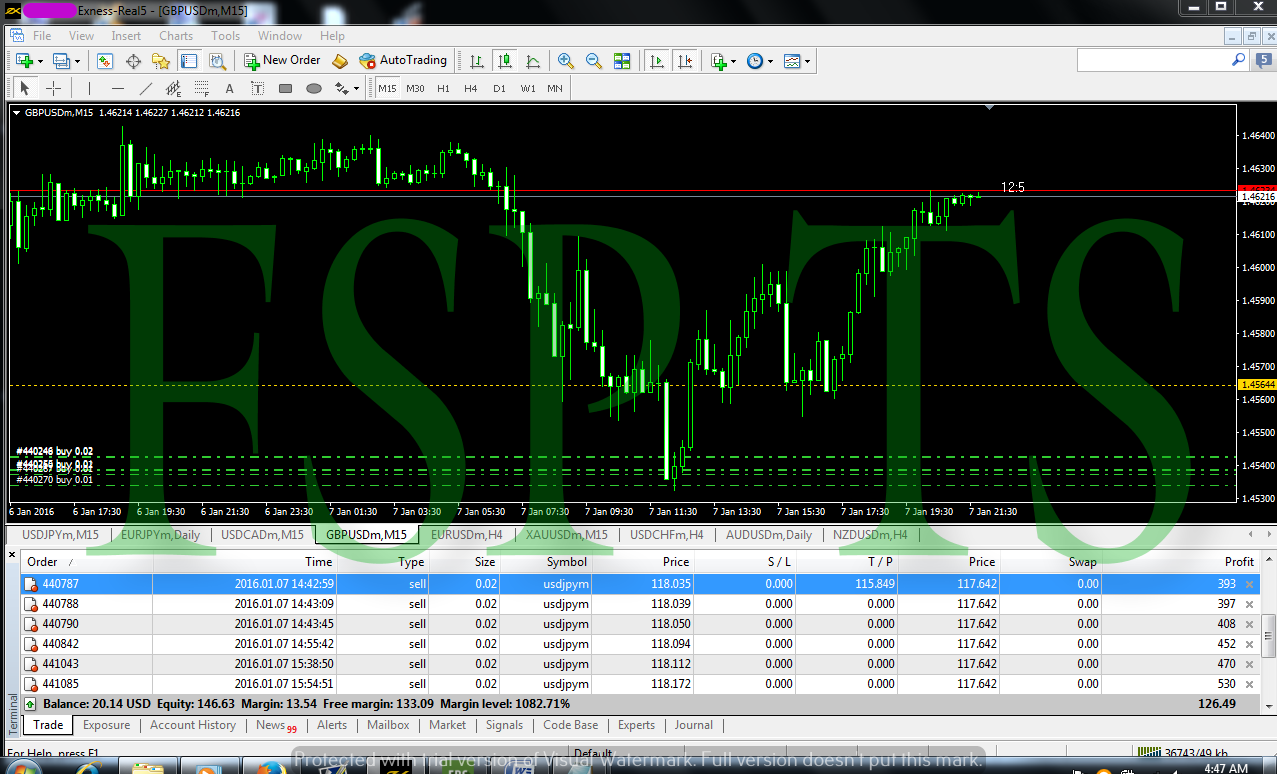

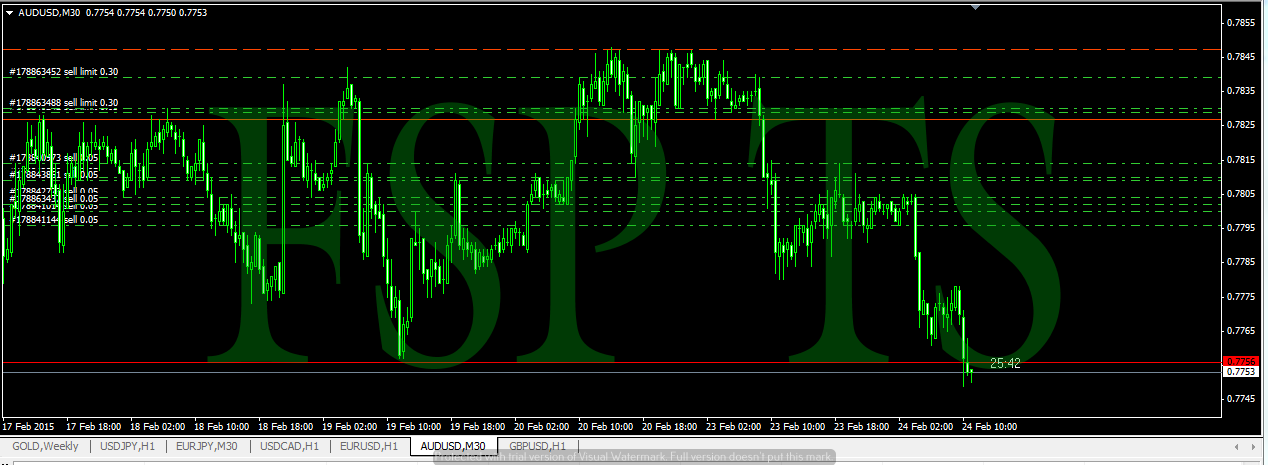

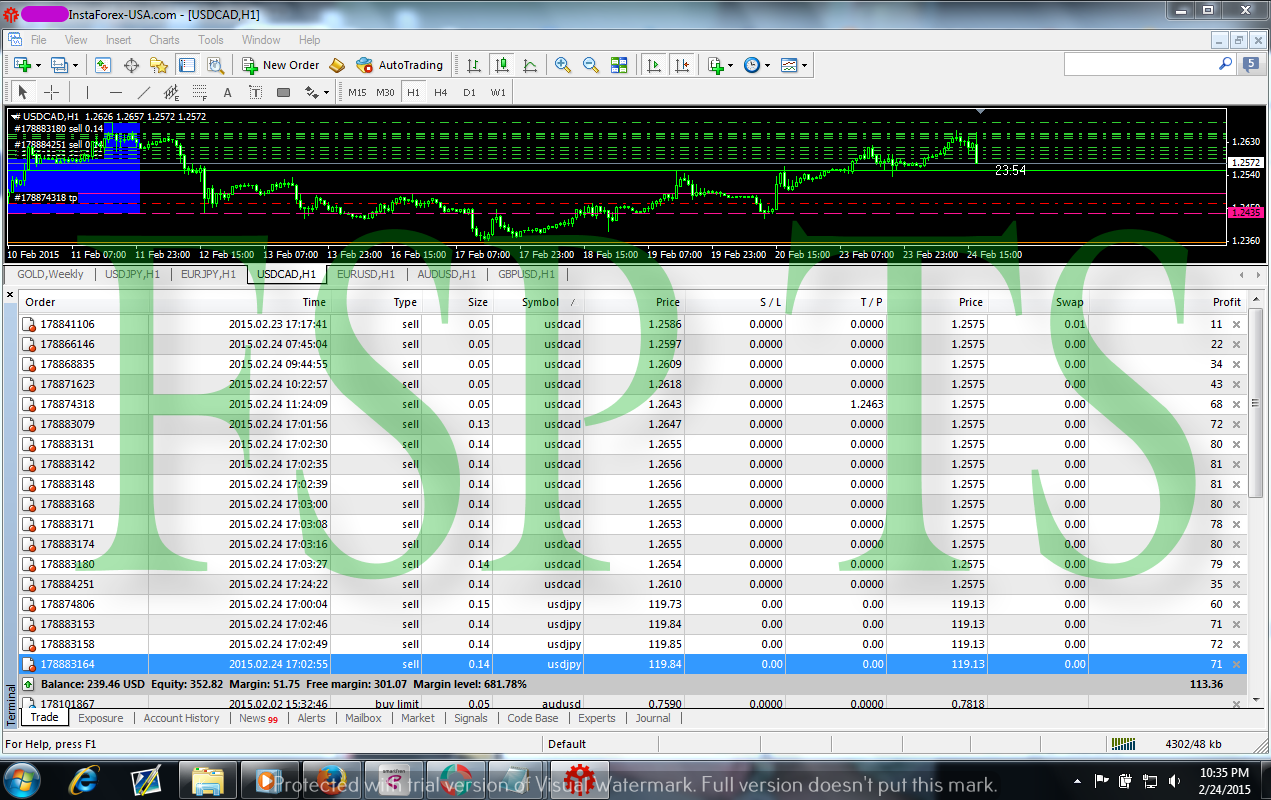

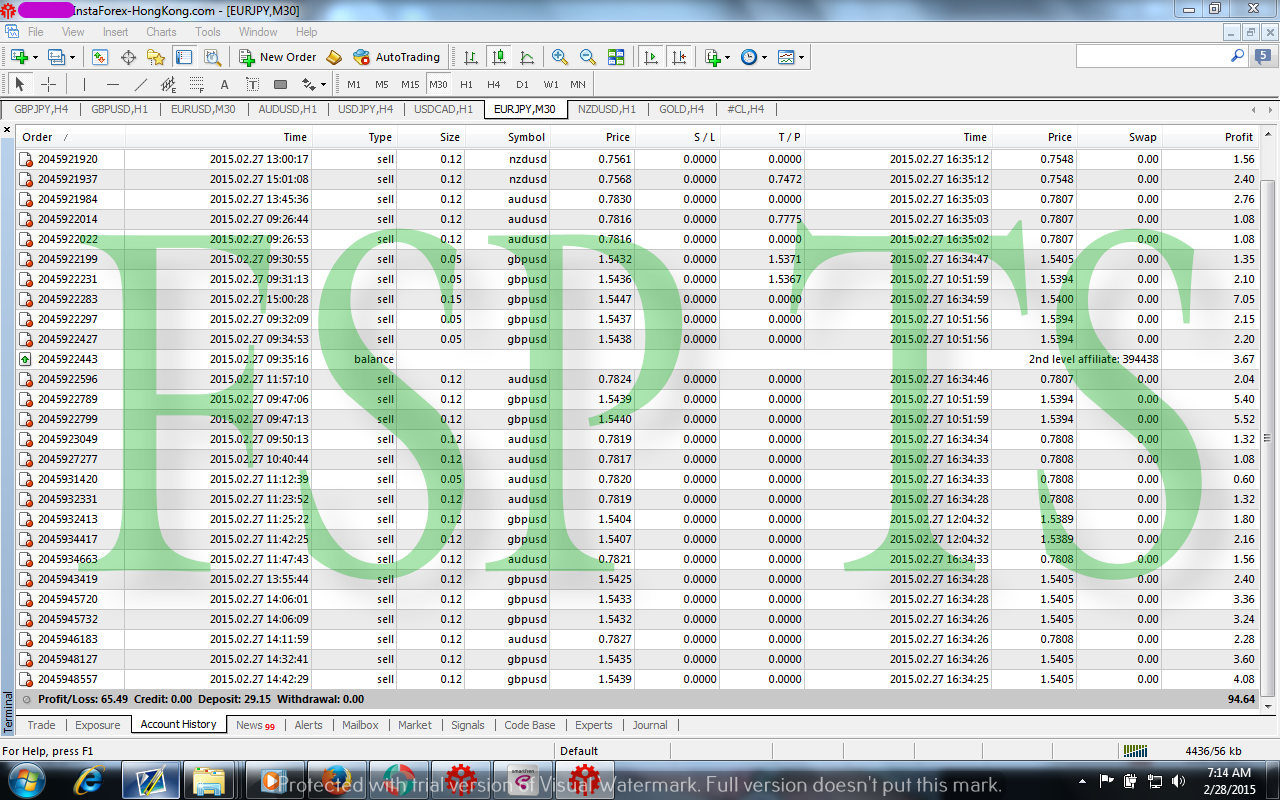

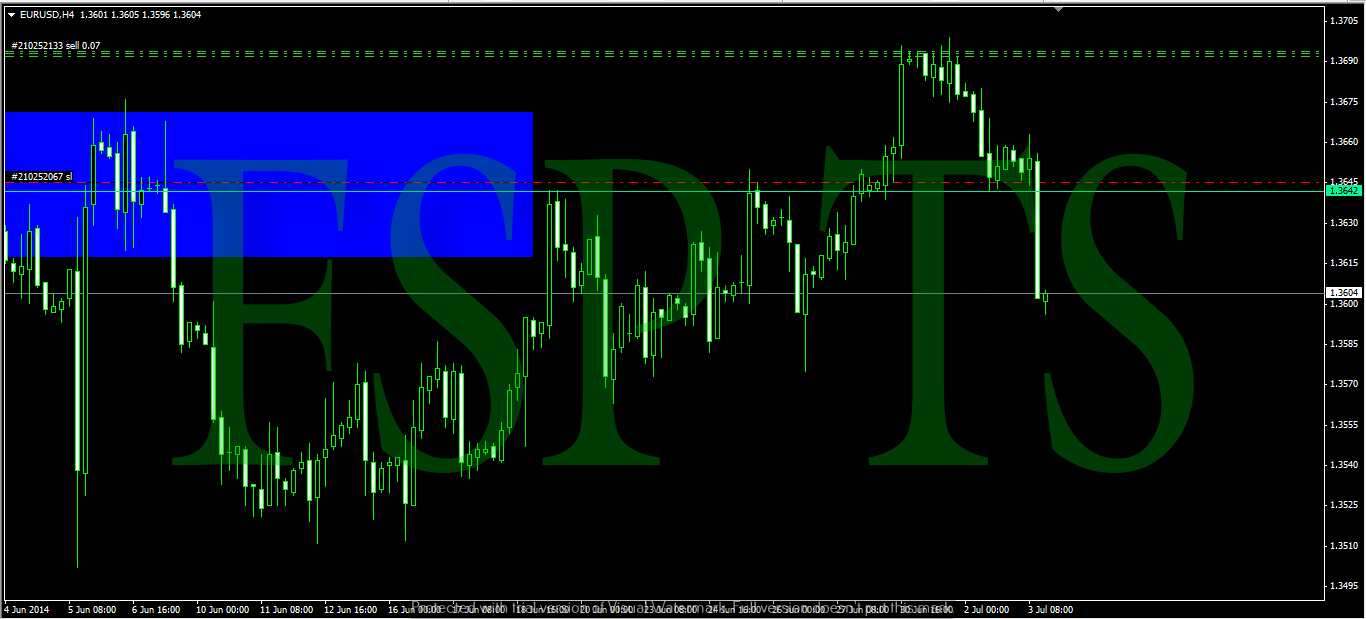

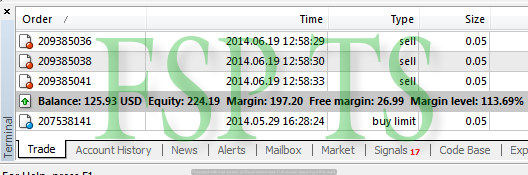

Some performances can be seen below :

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|