Swing Trading Definitions

Swing trading means watching for short-term price movements, and then taking advantage of these movements by buying low and selling high. This is not day trading – day trading has no reliable data as the period is too short and you can’t make money. The stock market trading game can be played in many ways, and trades may be undertaken for short or long-term goals. A swing trading system will help you find stocks that have the potential for price fluctuations in the near future. When you use this trading strategy you will not hold investments for more than three or four days, and you are looking for short-term profits with more trades being performed than long-term investors will have.

The right swing trading system for you will be consistent with your investment goals, and the level of risks that you are willing to take. Every investor is different, with different goals and trading methods, so there is not one system that works well for all investors. Look at the swing trading system possibilities, and evaluate each system based on the interface, ease of use, effectiveness, and cost. When you compare all of your choices you can eliminate any choices which are not right for one reason or another. Will the system you are considering help you be a more successful trader, with more profits and fewer losses? Look for systems that are easy for you to use, and that help you find stocks that have the most potential for returns within your specified time range.

Forex swing trading online provides the ideal market for the methodology of swing trading.

So why are currency markets the ideal for swing trading?

Let, first of all, define what forex swing trading is….

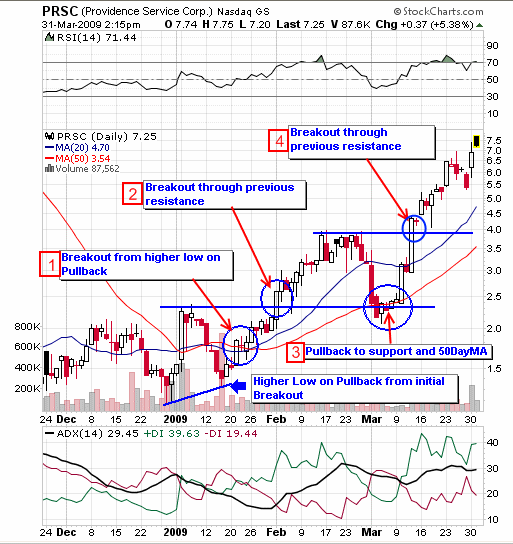

Forex Swing trading aims to identify intermediate swings in price based on liquidity zones and support resistance areas that can last from anywhere from a few days, to a few weeks. Before diving into how swing forex strategy works, watch and learn about how to identify the accuracy of trading zones based on the support resistance forex trading strategy that almost works in every market condition below.

The following conditions make FOREX swing trading potentially such a lucrative way of trading

Liquidity

Each day the global forex markets see trillions of dollars transacted.

This is a 24-hour market and is the world’s biggest investment marketplace.

The huge size of the markets allows traders to open and close transactions quickly, lock in profits and minimize losses.

Volatility

Currency markets are volatile and this is why a short-term trading method such as forex swing trading can be so profitable.

A volatile moving market is essential for swing trading.

This volatility means a large number of potential opportunities that are presented to forex traders.

Transaction costs

Low transaction costs that were once the preserve of large institutions, now any trader can get 3 – 5 pip spreads meaning short-term trading is viable for any trader

While currencies present long-term trends, there are many profitable swing trading opportunities within them.

These shorter trends last for a few days to a few weeks and they offer regular high reward low-risk trading opportunities for forex swing traders

Many traders lack patience and want to take quick action well that’s exactly what you get with forex swing trading.

FOREX swing trading offers them a lot of trades regularly and you don’t need the patience of a long-term trend follower.

Swing trades tend to either run to profit quickly or lose, keeping the trader interested, motivated, disciplined, and focused.

This is an ideal way of trading for someone who loves trading.

Forex swing trading is also easy to learn you can simply use support and resistance lines with some confirming momentum indicators. For example, we use just stochastics and

RSI – It’s simple and a stress-free way of trading and best of all can make big profits with low risk.

FOREX Swing trading is fun and very profitable and that’s the way trading should be.

One moment you decide to trade forex, you need to learn very well about various kinds of forex trading systems. It is important so you can decide which system is the most profitable for you. One forex trading system you ought to know is the swing trading system. It is a type of forex trading that enables the trader to take benefit of the fluctuation or swing of currency price over a period of time. But it is also possible for you to trade within the same trading day before the market is closed for the trading day. It is called a day trading system. It is a very popular trading system among casual, at-home traders today.

Conclusion

There are various kinds of day trading strategies. One of them is the entry strategies. This strategy requires you to enter the ideal candidates for your stock on the day trading. If you use this strategy, you need to understand very well about volatility and liquidity. Both are the basic concepts that will help you in knowing more about how to day trade. If you have no idea about what to do with your stock, you can get help from swing trading software. You can find many kinds of trading advisor software that can help you run your forex trading business very well.

One benefit you can get from a day trading system is that you can buy and sell so many times on one trading day. It is because day trading focuses on very short-term trading so it enables your trading to last in a few minutes. Another advantage you can get from a day trading system is that you may get trading fee discounts from your broker. It is given to you because of your trading volume. The day trading system gives you a chance to earn money without leaving your home.

My recommendation is if you want to use the best swing strategies only use the ICT trading strategy and candlestick reversal patterns which appear at strong support resistance levels that often happen at a four-hour time frame and daily time frame. Also using the Fibonacci retracement strategy to measure the condition is it retrace or reversal?

Major candlestick reversal patterns that usually appear are doji, engulfing, morning/evening doji stars, marubozu, hammer, and shooting stars. Because almost all forex indicators are lagging as usual, the key to this candlestick reversal strategy is to identify a strong support resistances zone from a daily or four-hour time frame first, then the second step is waiting for candlestick reversal patterns formed on this S/R zone, if this candlestick reversal signals didn’t appear or form, so then the market will continue to test last higher high or last lower low, but if candlestick reversal signals appear on this S/R zone and it formed at least on four-hour time frame or daily time frame better so it would be a valid reversal signal and the last step is using the right money management and you’ll stay away from margin call, this is best swing trading system that I’ve found that I still using this support resistance strategy for my living cost.

Just another share about forex analysis using candlestick reversal patterns combined with supply demand strategy or what many traders call The Candlestick Trading Bible.