Are Using A Good Forex Expert Advisor

If you are interested in starting a forex business, it’s better for you to look for the best forex expert advisor first. It is a program that is specially designed to use mathematical algorithms and scour real-time market data to search for a profitable trading option to act on. It operates by reacting to the changes in the market so you can be sure that this program is effective and low risk. It is also very suitable for less experienced and new traders. By using this program, you are not required to do anything.

If you are interested in starting a forex business, it’s better for you to look for the best forex expert advisor first. It is a program that is specially designed to use mathematical algorithms and scour real-time market data to search for a profitable trading option to act on. It operates by reacting to the changes in the market so you can be sure that this program is effective and low risk. It is also very suitable for less experienced and new traders. By using this program, you are not required to do anything.

But you probably won’t get huge profits with the help of this program. But some forex expert advisors can give us steady profit monthly. The forex expert advisor can only help you in gaining small, reliable profits without any participation from you. But it can be a great learning tool for you who are serious about trading by yourself.

Are you looking to boost your forex trading success with the help of an expert advisor? Choosing the right forex EA can make a significant difference in your trading experience and overall profitability. But with so many options available in the market, how do you know which one is the best fit for you?

In this article, we will walk you through the essential factors to consider when selecting the best forex expert advisor for your trading needs. We will explore key features, performance metrics, and compatibility with different trading platforms.

Our expert team has done extensive research to bring you an unbiased review of the top forex expert advisors in the industry. We will delve into their strategies, risk management techniques, and past performance.

Whether you are a beginner or an experienced trader, this guide will help you make an informed decision when choosing a forex expert advisor. Don’t make the mistake of settling for just any EA – find the one that aligns with your trading goals and preferences. Start maximizing your trading potential today!

Understanding the Importance of Choosing the Right Forex Expert Advisor

When it comes to forex trading, having the right tools and resources can greatly enhance your chances of success. One such tool is a forex expert advisor (EA), also known as a forex robot. These EAs are designed to analyze market conditions, identify trading opportunities, and execute trades automatically on your behalf.

The importance of choosing the right forex expert advisor cannot be overstated. The wrong EA can lead to poor trading results, while the right one can significantly improve your profitability. It is crucial to consider various factors before making a decision.

First and foremost, you need to assess your trading goals and preferences. Are you a conservative trader looking for steady returns? Or are you more aggressive, seeking high-risk, high-reward opportunities? Understanding your trading style and objectives will help you narrow down your options and find an EA that aligns with your needs.

Next, consider the level of automation you desire. Some EAs offer fully automated trading, while others provide more manual control. Depending on your experience level and comfort with automation, you can choose an EA that suits your preferences. Keep in mind that fully automated EAs may require less time and effort on your part, but they may also limit your ability to intervene in trades.

Lastly, take into account your trading platform and broker compatibility. Not all EAs are compatible with every trading platform, so ensure that the expert advisor you choose works seamlessly with your preferred platform. Additionally, check if your broker allows the use of EAs and if there are any specific requirements or restrictions.

By understanding the importance of choosing the right forex expert advisor and considering these factors, you can set yourself up for success in your forex trading journey.

Factors to Consider When Choosing a Forex Expert Advisor

When it comes to selecting the best forex expert advisor, there are several factors you should take into consideration. These factors will help you evaluate the EA’s performance, reliability, and suitability for your trading needs. Let’s explore each of these factors in detail.

- Strategy and Trading Approach: The first factor to consider is the EA’s trading strategy and approach. Different EAs employ various strategies, such as trend following, scalping, or grid trading. It is essential to understand the strategy employed by the EA and determine if it aligns with your trading style and goals. Additionally, consider if the EA offers customizable settings to adjust the strategy to your preferences.

- Past Performance: Examining the EA’s past performance is crucial in assessing its potential profitability. Look for verified trading results and track records over an extended period. Analyze the performance metrics, such as win rate, average profit/loss per trade, and maximum drawdown.If you are looking for the best forex expert advisor, you should choose the one that trades more conservatively. The more aggressive forex expert advisor is not recommended because this kind of forex expert advisor will trade overly aggressively. Not only that, it will also go for any trades. Type forex expert advisors are many, there is averaging with fix lot, martingale, martingale combined hedging, pure hedging or pure martingale, correlation pair signal, and many more. But one of my favorite forex expert advisors is using accurate support resistance based on daily and combined with averaging based valid support resistance from a four-hour time frame and entry it with some indicator to enter that signal on five teen minutes chart time frame. For this kind of forex expert advisor complete collection is very recommended for all types of traders because is safer to get healthy capital gain. This forex expert advisor gives us a stable profit of at least 20% per month and a low draw-down loss ratio below 20% or a max of 30%.The way to choose a forex EA is of course by looking at the maximum drawdown value, if it is above 50% it is not recommended. The recommended maximum drawn down is no more than 40%, the intensity level of open orders does not exceed 10% of capital, and the duration of consistent profits should be at least 2 years to provide stable profits.

You can immediately choose various types of automatic trading strategies using forex expert advisors that are listed on mql4. Apart from providing a wide selection of forex trading robots, the mql4 official website also offers a direct forex copy trading signals program offered by professional forex traders from all over the world. Forex copy subscription fees are very flexible starting from just $5. Remember that past performance does not guarantee future results, but it can provide valuable insights into the EA’s capabilities.

- Risk Management: Effective risk management is vital in forex trading. Evaluate the risk management techniques employed by the EA, such as stop-loss orders and position sizing. A good EA should have robust risk management measures in place to protect your capital and minimize losses. Consider if the EA allows you to customize risk parameters according to your risk tolerance.

- Support and Updates: When choosing an EA, ensure that the developer provides reliable support and regular updates. The forex market is dynamic, and the EA needs to adapt to changing market conditions. Check if the developer offers ongoing support, updates, and a community forum where you can interact with other users and share experiences.

- User-Friendly Interface: The usability and interface of the EA can greatly impact your trading experience. Look for an EA that is easy to install, configure, and navigate. A user-friendly interface will save you time and make it easier to monitor and manage your trades. Consider if the EA provides a detailed user manual or tutorial videos to help you get started.

By considering these factors, you can narrow down your options and choose a forex expert advisor that suits your trading needs and preferences.

Researching and Comparing Forex Expert Advisor Options

With numerous forex expert advisors available in the market, researching and comparing your options is crucial to finding the best fit for your trading needs. Here are some steps to help you in your research process.

- Identify Your Requirements: Before diving into the vast pool of EAs, identify your specific requirements and preferences. Consider factors such as trading style, risk tolerance, desired level of automation, and compatibility with your trading platform. This will help you narrow down your options and focus on EAs that meet your criteria.

- Read Expert Reviews: Expert reviews and comparisons can offer valuable insights into the performance, features, and pros and cons of different EAs. Look for reputable websites, forums, or blogs that provide unbiased and in-depth reviews. Pay attention to the reviewer’s experience and expertise in forex trading.

- User Reviews and Testimonials: Reading user reviews and testimonials can provide valuable feedback from actual users of the EA. Look for reviews on independent platforms or forums where traders share their experiences. Keep in mind that not all reviews may be genuine, so consider multiple sources and look for consistent feedback.

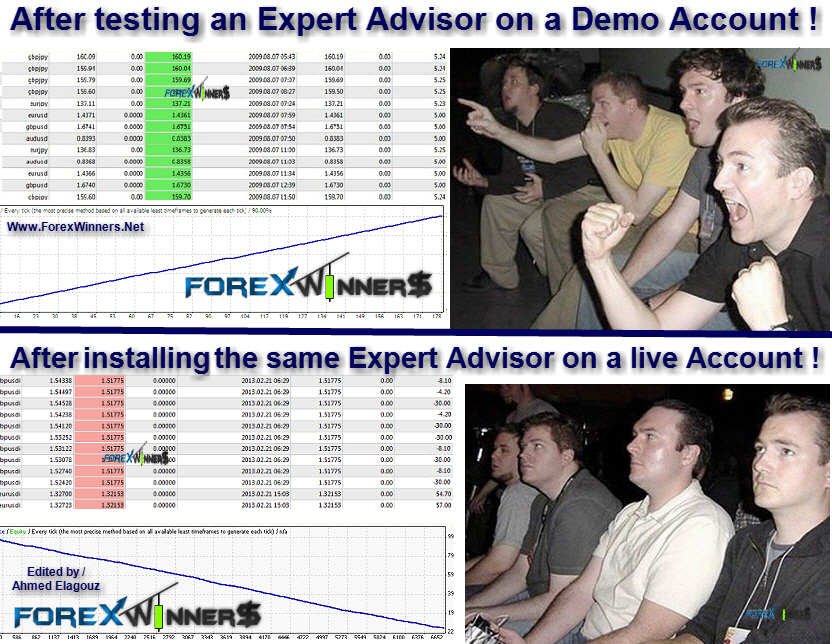

- Demo Accounts and Trials: Many EA developers offer demo accounts or trials to allow users to test the EA’s performance and features before making a purchase. Take advantage of these opportunities to familiarize yourself with the EA and assess its compatibility with your trading style. Evaluate the EA’s performance in different market conditions and analyze the trade results.

- Consider Expert Advisor Rankings: Some websites or platforms rank EAs based on various criteria, such as performance, risk-adjusted returns, and user ratings. These rankings can give you a starting point in your search for the best forex expert advisor. However, it is essential to consider the ranking methodology and conduct your research to validate the rankings.

Remember that researching and comparing different forex expert advisors may take time and effort, but it is a crucial step in finding the EA that best suits your trading goals and preferences.

However, every effort to obtain consistent profits in forex has been taken. The most basic thing to obtain consistent trading profits in the forex market is how we understand how market prices work or what is called the basic concept of market structure itself which we must understand. Here is a little explanation of how the market price structure works and how we should enter the forex market.

How To Read Market Structure Properly

The more conservative program is the best choice for a profitable forex expert advisor. You can be sure that it can trade completely independently. You also need to make sure that you get a full money-back guarantee from that automatic forex robot. It helps to prevent the less reputable publishers that promoting ineffective programs. They are usually only longing to capture your money by promising overnight wealth with the help of their products. As we know many forex expert advisors have many advantages for traders because of their consistency in analyzing the market 24/5.

The more conservative program is the best choice for a profitable forex expert advisor. You can be sure that it can trade completely independently. You also need to make sure that you get a full money-back guarantee from that automatic forex robot. It helps to prevent the less reputable publishers that promoting ineffective programs. They are usually only longing to capture your money by promising overnight wealth with the help of their products. As we know many forex expert advisors have many advantages for traders because of their consistency in analyzing the market 24/5.