The Commitment Of Trader

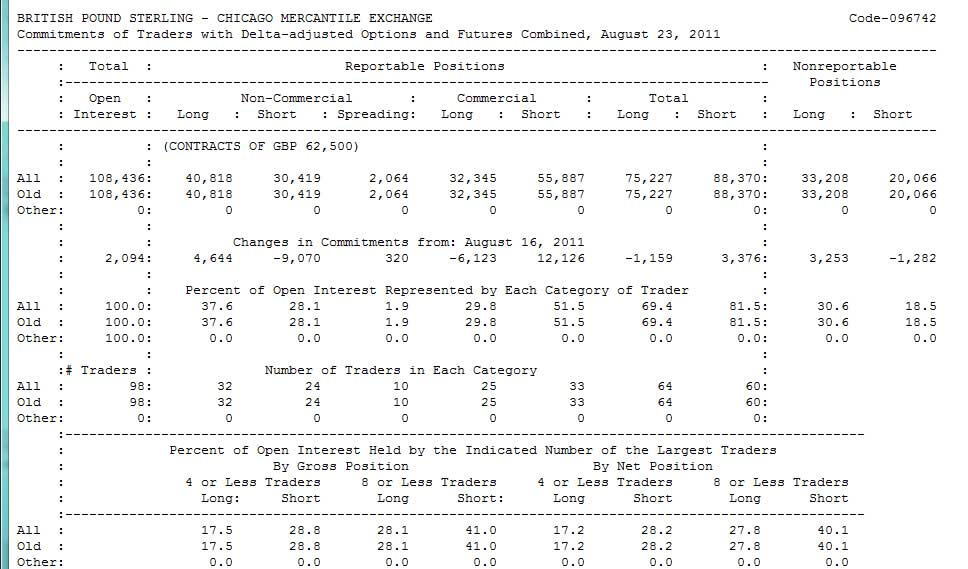

The Commitment Of Trader – COT report provides some positioning information about the futures market and it is one of the most underrated tools that forex traders can make use of to increase their trading performance. The report is compiled and released weekly by the Commodity Futures Trading Commission (CFTC) in the United States every Friday at 15:30 Eastern Time, and records open interest information about the futures market based on the previous Tuesday. Anyone can access the COT report for free on the CFTC official website. You can update this COT report every Sunday here

.

The commitment of traders (COT) weekly report is based on the data published every Friday by the U.S. Commodity Futures Trading Commission (CFTC). It seeks to provide investors with up-to-date information on futures market operations. It contains reportable (commercial and non-commercial holdings) and non-reportable positions. However, non-commercial holding is an important signal of the futures traders’ sentiment that can be a very powerful trading tool to help anticipate market direction. Therefore, looking at the net position changes, it will help determine the likelihood of a trend continuing or coming to an end in the near future.

How do I read the Non-commercial net position changes?

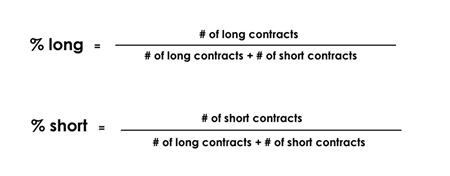

Positive means a net long position, and negative means a net short position. When the net position changes show that the net long position is decreasing, this indicates the market sentiment is down and vice versa, when the net long position is increasing, it indicates the market is optimistic.

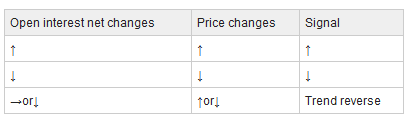

How to read the open interest net changes?

COT report usually shows you how the big guns are playing their cards and in my experience, it can be used in different ways to make your trade calls more profitable. I do not intend to reinvent the wheel. I look at similar thread topics in FF to see if anyone else has come up with a discussion or analysis of the COT report. I have not seen any so I decided to open this thread and provide some insight and materials (which you can get from reading some good trading books) about the COT report and share some of my experience and ideas in this regard.

Well, back to the COT report and how to use it COT report arrives three days late but the information nonetheless can be helpful since many traders spend their weekend analyzing the COT report. The time lag between reporting and release is the main handicap of the COT data, but despite this limitation, you can still use it as a sentiment tool. In this report, you can see the long and short positions held by traders in each of the three main categories defined by the CFTC. These categories are:

-

- Commercial: These are the big businesses that use currency futures to hedge and protect themselves from too much exchange rate fluctuation.

- Non-commercial: This is a mixture of individual traders, hedge funds, and financial institutions. For the most part, these are traders who looking to trade for speculative gains. In other words, these are traders just like you.

- Open interest describes the amount of open futures contracts that are being held. In other words, it is the total volume of open contracts in the market, but not the transactions.

- Non-reportable positions cover everyone who does not suit the above criteria, and they are also termed small speculators. Of reportable positions, non-commercial includes all actors who do not possess any interest in making use of the underlying currency or commodity, such as hedge funds, brokerage firms, investment banks, and other related firms. Commercial open interest is created by firms that have the desire to receive or deliver the underlying. Thus the roles played by the two categories of traders is quite different.

Spreading covers those trades that hold an equal number of long-short positions on future contracts.

- Long: That’s the number of long contracts reported to the CFTC.

To understand the futures market, first, you need to know the people making the shots and those who are warming up the bench. These players could be categorized into three basic groups:

Commercial traders (Hedgers)

Non-commercial traders (Large Speculators)

Retail traders (Small Speculators)

The COT report tells you the long and short positions undertaken by participants from each category. When it comes to analyzing information about currency futures in the COT report, it is generally more relevant for traders to focus on the noncommercial/Large Traders participants rather than on the commercial participants. The reason behind this is that these large speculators trade the futures contracts mainly for profits, and do not have the intention to take delivery of the underlying asset, which in this case would be cash. On the other hand, commercial participants tend to maintain and roll over the same amount of contracts from month to month for hedging purposes even though these positions could be in losses. Large speculators, however, will usually close their losing positions instead of rolling them over to the next month.

Below is a step-by-step process on how to create this index.

-

- Decide how long of a period we want to cover. The more values we input into the index, the less sentiment extreme signals we will receive, but the more reliable it will be. Having less input values will result in more signals, although it might lead to more false positives.

- Calculate the difference between the positions of large speculators and commercial traders for each week.

The formula for calculating this difference is:

Difference = Net position of Large Speculators – Net position of Commercials

Take note that if large speculators are extremely long, this would imply that commercial traders are extremely short. This would result in a positive figure.

On the other hand, if large speculators are extremely short, that would mean that commercial traders are extremely long and this would result in a negative figure.

- Rank these results in ascending order, from most negative to most positive.

- Assign a value of 100 to the largest number and 0 to the smallest figure.

In my experience using COT is best for GBPUSD, USDCAD-inverse, GBPJPY, AUDJPY, AUDUSD, EURUSD, NZDUSD, and GOLD. You can read the COT report for gold, silver, and copper at here.

The COT report is a very useful tool that can be substituted for the volume indicators of stock analysis. Absolute long and short positioning and historical comparisons can be useful for identifying market extremes. Percentage changes in open interest can be valuable in noting position flips and predicting market reversals in the medium term. If there ever were an ultimate technical indicator, its seekers have their greatest luck in COT data. But the old advice on not putting all eggs in the same basket is still valid: it’s better to confirm signals from the COT report with data from other aspects of TA, and of course fundamental analysis, before reaching decisions. And remember always using good forex brokers too as seen in the list below at the end of this article.

Practice wise money management in using this accurate swing forex trading strategy in free 30USD by opening an account and making a first deposit with Tickmill or ROBOFOREX PRO CENTS Account.