Forex Money Management

Good money management skills are the single most important difference between amateur and professional traders. You heard me. If you have ever dreamed of becoming a successful forex trader, you must learn money management.

Money management has nothing to do with how you budget your spending or how much you put into your Forex account. Whether you put $1000 or $10,000 into your account is not what we are talking about here.

Money management is all about managing risk. All of us who trade currency have some tolerance to risk. But there’s a difference between having the ability to take risks and engaging in risky behavior.

There was a recent story where a trader who worked for one of the big banks made some bad trades and ended up losing the bank over a billion dollars. What happened? He was simply not following basic money management rules that would have saved his bank a lot of money, and probably his career as well.

You do not want to end up like this guy for two reasons. First of all, you will be trading with your own money, so losing your life savings is simply not an option. I am assuming you started trading forex to increase your income, not put your life savings at risk. Secondly, you are smarter than that. If you are reading this, it means you are smart enough to know that education is the most powerful weapon in this game. Learning just a simple strategy for managing your bankroll will reduce the amount of headaches and heartache significantly. The following technique is a simple, yet powerful rule that many experienced traders still take to heart:

Never risk more than 5% of your account balance

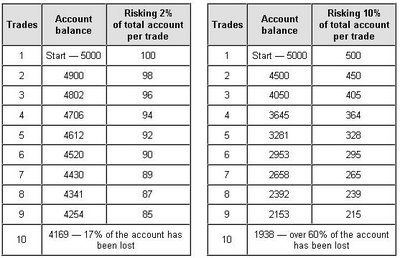

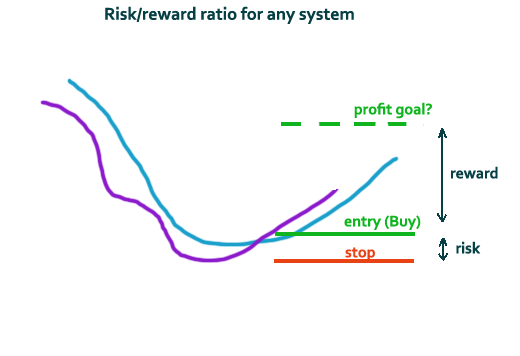

This is one of the most simple money management techniques out there, and it works. It simply states that for every trade you make, you should not risk more than 2% of your balance. Say you just opened up an account today and deposited $5000 in it. You know that 2% of $5000 is $100, but what does this mean for your trade? It simply means that you will put in a stop loss such that it will close the position automatically if you lose $100 on that trade.

However, for certain online forex brokers, you will need to specify the price of the stop loss as opposed to the dollar amount. Let’s assume you are trading a mini lot (10K units), which means each pip is worth approximately $1. Remember that 1 pip is 0.0001 dollars.

In our scenario, you can only risk 2% or $100 of your $5000 account balance. Say you bought 1 mini lot (10K units) of EUR/USD at 1.41678, then the stop loss should be set at 100 pips below that amount, which is 1.41678 – (0.0001 * 100) = 1.40678. This means that if the trade starts going drastically against you, you will be stopped out at 1.40678, with a maximum loss of $100.

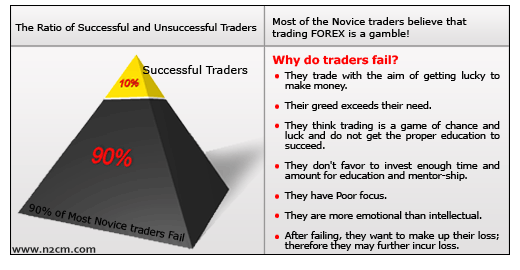

Why is it important never to risk more than 2% of your account balance? Well, the biggest advantage is that it takes the emotion out of trading, which is a very good thing. Emotions and trading do not mix well. Losing is never a good feeling, but losing 2% is a lot easier to swallow than losing 50% of your bankroll.

When you lose 50% of your account balance in one trade, funny things start to happen. You will feel the need to gain it all back in one trade, so you risk even more to break even. This usually leads to disaster and you will see your account balance dwindle down to zero in no time.

Now what happens when you lose 2% of your account balance? Well, it’s only 2%, so you move on to the next trade without much thought. You can have 10 trades go against you in a row, and still be down only 20%. The beauty of this rule is that it will keep you in the game a lot longer.

When to Apply the Golden Rule

In a word, always. When you are first starting, apply the 2% rule on each trade with no exception. Do not lose focus and do not adjust your stop loss when the trade is not going your way. Once you are more experienced, you may try out other advanced money management techniques that also work quite well.

Join Forex Managed Account Services Or Get Limited Secret Ebook Trading Strategy Based Candlestick

Discipline is one of the keys to becoming a successful forex trader. If you know you are not disciplined and know you will not become a disciplined trader, I would recommend withdrawing all of your money right now and putting the money elsewhere because forex is not for you. Being disciplined is not easy, and that is precisely why so few people ever profit from trading forex.

It takes hard work to be disciplined. Place a reminder in front of your computer and make it a habit to always use a stop loss and never risk more than 2% on a single trade.

Summary

Money management may be a foreign topic for most people, but it shouldn’t be. It should be at the forefront of every single trade that you make. It should not be an afterthought, and definitely should not be forgotten. Let me reiterate the importance of applying the 2% rule on each trade. By following a simple money management technique like the 2% rule, you will increase your chance of success significantly.

Lastly, test your best trading strategy in cents account first in EXNESS, ROBOFOREX, and FBS forex broker with cents account first and use 1:1000 leverage.