Pivot Breakout Strategy for Intraday Traders

As we know pivot is a median value from the trend. But, what kind of pivot-based calculated? is it from Fibonacci or even based only on the Doji candlestick? Yes, both are good. Actually, my pivot point is usually based on body doji itself where have placed in the range of candlestick reversal patterns from a big time frame at least daily and better based weekly. But, now I won’t talk about doji as my pivot point. So, whatever your pivot is based on, this easy pivot breakout trading strategy is very powerful, even more so using pivot-based H4, D1, or Weekly timeframe.

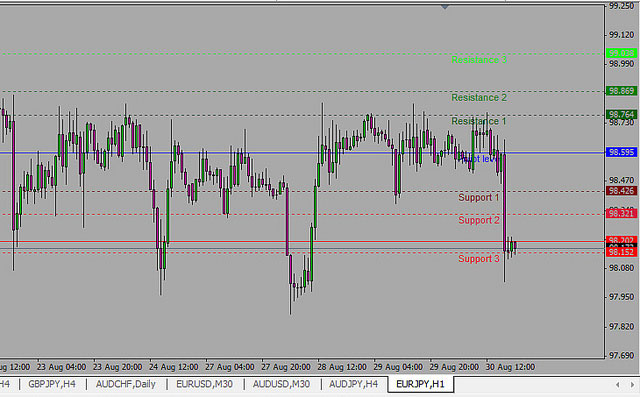

Here a simple picture from an easy breakout pivot trading strategy explained.

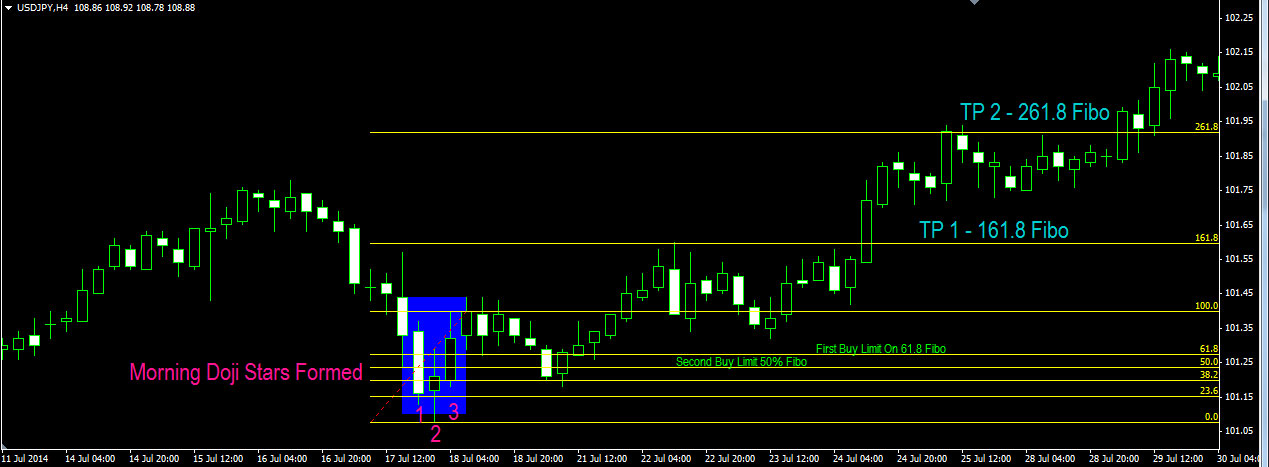

As we can see from the picture above, we can see candlestick reversal patterns formed after the price breakout pivot level. And if candlestick reversal patterns appear or are formed in a four-hour time frame or even better if formed in a daily time frame it becomes our validation trend will reverse. So, my suggestion is to wait for a pullback after candlestick reversal patterns formed at least 50% or 61.8% level of Fibonacci from the range of candlestick reversal patterns itself.

Here is our picture detail to get the best entry after candlestick reversal patterns are formed.

So the first thing to do is: we have to understand is candlestick reversal patterns itself, and then combine it with the pivot breakout level as our confirmation valid signals. These two combination analyses if very accurate enough and most professional traders use the pivot breakout strategy.

So, just download it on our indicators collection and try it with yourself to see how good this strategy is.

Conclusion

The best idea is that we can apply this pivot breakout technique in multi-timeframe analysis. For example, we determine the pivot on the h4 or daily time frame, then if the price is above the pivot level of course we only look for buy confirmation on the small time frame (m5, m15, m30, h1) and vice versa, if the price is below the pivot level, our task is just to wait and look for confirmation signals in the best area on a small time frame.

A Powerful Pivot Point Forex Trading Strategy

Pivot Point Trading Strategy Explained

And lastly, the best of the best indicators is the candlestick reversal patterns and the second one is like pivot point or any other non-lagging forex indicators never use a bad forex broker in trading forex with our real money, just use tested and good review forex broker such icmarkets ecn, fusion markets, pepperstone, roboforex, exness, vt markets, hot forex market and many other more with a good forex broker reputation.

Understanding first candlestick reversal patterns and then we can get a top-ranked forex analysis and use this pivot breakout as a confirmation signal.