Best Price Action Forex Trading Strategies

We need accurate forex trading strategies to make consistent profits in the forex market. As we all know forex is the most popular and highest trading market across the globe. Every day thousands of people are attracted to Forex trading to gain quick money. This across-the-counter trading involving the major currencies is a bit tricky yet highly profitable trade, which needs a good understanding of Forex trading. This can be seen by the percentage of people every day, who lose their money in trading due to lack of proper knowledge and skills. This makes the other 5 to 10% of people gain huge profits. However, with good observation, and learning of the Forex trading strategies, anyone can make profits or at least secure their hard-earned money.

Maybe we already know and study various kinds of forex strategies based on price action movement. Sometimes we have difficulty putting together the puzzle of this variable price action, making it difficult to get an entry accuracy zone that has a very minimal risk and high potential for swing reversals. After reading and trying to learn from various kinds of price action strategies starting from head and shoulders patterns, Quasimodo reversal patterns, Flag and Pennant, Cup, and Handle Top and Bottom, double – triple top/bottom, Ascending and Descending Triangles, trend line combined with price action, The Three -Drive Pattern, The ABCD Pattern (Fibonacci Price Action), falling and raising wedge, candlesticks reversal patterns, Elliot wave and many more that I can’t mention all of them here.

While there are several different profitable trading strategies that one can use to trade the forex market there are certain characteristics that the best forex trading strategy should contain. Quite simply put, the strategy you use to trade the forex market, focuses on one trading system that is suitable for our cycle time of life…

Price Action Forex Trading Strategy – Trading With The Banks!

In this article, I will share about 2 price action methods that in my opinion are very accurate in providing weekly profits for all of us.

These 2 methods of price action trading strategy that work are:

1. Institutional Candle strategy often called the block order trading strategy, and

2. Quasimodo manipulation trading strategy.

That 2 price action forex trading strategy above will give the structure of a true signal with an effective low-risk technique. Even institutional traders also depend on this.

Learning How To Read Market Structures & Apply It On Our Trading Strategy, Ultimate Guide For Intraday Forex Strategy Based Price Action Trading Rules :

What Is Liquidity Trading Forex Strategy?

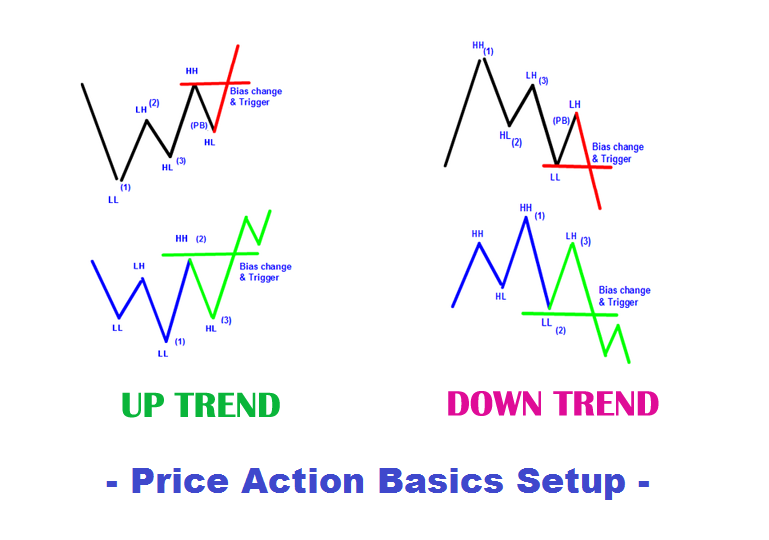

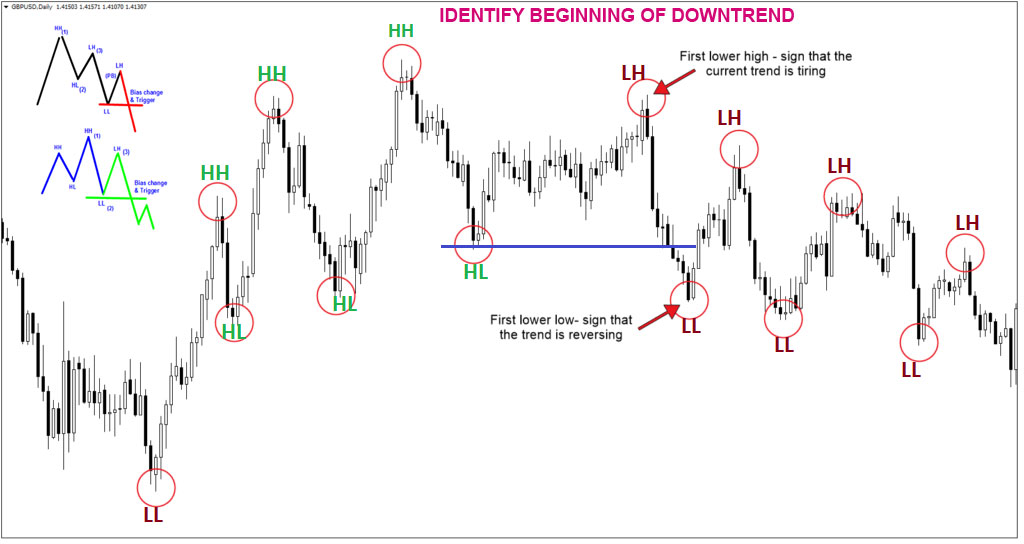

But, before using these 2 price action methods, this confirmation of price action setup basics below must be understood to get early momentum, because breakout pattern-based price action wave is always used in the small time frame as our first confirmation signals and must appear in near-based or zone range.

I’ve found this method from Sam Lowe – Psych FX, Pips Of Persia, and Fxalexg channel.

Learn more and more about this video tutorial about price action structure directly from the winner because of his or her patience in learning the forex market structure. The key is never to give up until you get what you want.

Best Pullback Trading Strategies In Forex – The Pullback Mastery Guide

From Sam Lowe and Pips Of Persia channel, you’ll understand what is institutional candle and order block easily so then you’ll get SNIPER Entries With Institutional Trading [Step by Step Guide].

From Kak Nora (ByStra) you’ll get how the market structure works and can be seen from Quasimodo Manipulation Perspective.

There are many study cases to get a better understanding of how market structure works.

In any power trading strategy, a proven trading method will mean that through Forex strategy testing and by using trading risk management, no more than two or five percent of a total account value is put at risk in a single trade. This is key in the path to big Forex profits. Any trader beginning out will look at the trading methodologies available to them and decide to create trading rules for their Forex trading strategy.

The trading method of price action makes use of the inherently supplied data that every financial market generates about itself. Once you become a skilled price action trader you will be able to make all of your trading decisions from a simple price chart using candlestick patterns or standard bar chart patterns. The reason why price action trading is the best forex trading strategy is mainly because it is a simple method that does not confuse you or cover up the natural price dynamics that occur day to day in all markets.

You need to learn more about candlestick patterns and whether it’s more accurate or more strength in a four-hour or daily time frame. Need practice all the time. A proven trading method is hard to come by if we don’t practice reading price action trading patterns.

These two price action strategies should be flexible and differ by demand of trends.

Change of Character Simplified Tutorial – Smart Money Course

Here are some forward and back-tested forex price action trading patterns by strength or success rate :

- 7A. Bull Flag Pattern (67.13% Success) 7B. …

- 6A. Ascending Triangle Pattern (72.77%) 6B. …

- 5A. Ascending Channel Pattern (73.03%) 5B. …

- 4A. Double Top Pattern (75.01%) 4B. …

- 3A. Triple Top Pattern (77.59%) 3B. …

- 2A. Bullish Rectangle Pattern (78.23%) 2B. …

- 1A. Head and Shoulders Pattern (83.04%)

There is always a right time to buy or sell a currency pair; however, the exact time to buy or sell is relative to personal trading needs. When one feels it is the best time to sell a currency, you might feel it is the appropriate time for you to buy it. There is a best time to buy or sell a currency. It is relative and differs between investor trading strategies. The decision on whether to go long or short on a position relates to the risk appetite of the buyer and his forecast of the near future.

There are several aspects of absolute importance. These include strategy, both in terms of trading and money management, and education – both initial and ongoing and focusing on mastering a specific area whether that be a particular currency pair or aspect within the field – such as global economics of a particular country.

And for the last but not least,

There are more than 100 Forex trading strategies available for new entrants, and new strategies are added to them day by day. We have to focus on a single strategy that is good for all. Remembering this point, each user should learn the strategy, understand his trade and requirements, and make his strategy. To achieve this, the user may need to practice with minimal risk, till he understands the Forex trading and starts playing with it. At the same time, the user should be willing to take the risk of losing some of his hard-earned money in the process. But experience speaks for him, and maybe after some time, he might design his strategy to turn it into millions.

Several trading system recommendations are using price action, supply, and demand trading systems, and understanding candlestick basics itself. And don’t forget to use multiple time frame analyses before we make any trading decisions.

Conclusion

Once again, when you are new to Forex, it is advisable to create a practice account and see the results. This is a real, objective test, as even with trading with a “practice account” you will be trading within real conditions and the profit/loss figures you get are realistic. Experience is an important key to successful trading as well. The more you trade, the more you learn. Review trading errors of the past and fix them – this is the best Forex trading strategy. I hope we can understand this great e-book of price action trading strategy and The 28 Forex Patterns Complete Guide, and don’t forget to use IC MARKETS, HFM, ROBOFOREX, and EXNESS as liquidity provider layer 1 which provide honest price data feed in forex broker comparison in getting the top quality analysis.