It is okay for you to start forex trading activity for your new business. The most important thing to remember is that it is a must for you to understand about forex trading. In fact, you also need to learn more about swing trading forex strategies you need to understand. By knowing about those strategies it is hoped that you can do the forex trading action correctly to limit risks.

Swing trading in the forex market can be a game-changer for traders looking to capitalize on short-term market movements. With its focus on capturing smaller price swings over a few days to weeks, swing trading offers a unique approach to forex trading. But how do you navigate this strategy effectively?

In this article, we will explore four different swing trading forex strategies that can help you enhance your trading skills and achieve consistent profits. Whether you’re a novice trader looking to understand the basics or an experienced trader seeking new strategies, we’ve got you covered.

Understanding the Basics of Forex Trading

Before diving into swing trading strategies, it’s essential to have a solid understanding of the basics of forex trading. The forex market is the largest financial market globally, with trillions of dollars traded daily. It involves buying and selling currencies to profit from the fluctuating exchange rates.

To get started with forex trading, you’ll need to choose a reputable forex broker, open a trading account, and familiarize yourself with the various trading tools and platforms available. Additionally, understanding fundamental and technical analysis, risk management, and market psychology will be crucial to your success as a forex trader.

What is Swing Trading and Why is it Popular?

Swing trading is a trading strategy that aims to capture short to medium-term price swings within a larger trend. Unlike day trading, which involves opening and closing positions within the same trading day, swing traders hold positions for a few days to a few weeks, allowing them to take advantage of more significant price movements.

One of the reasons swing trading is popular among forex traders is its flexibility. Swing traders have the opportunity to generate profits in both rising and falling markets, as they can take advantage of both upward and downward price swings. This flexibility makes swing trading an attractive option for traders looking to diversify their strategies and reduce their reliance on specific market conditions.

The Advantages of Swing Trading in Forex

Swing trading in the forex market offers several advantages for traders. Firstly, swing trading allows traders to avoid the noise and volatility associated with shorter-term trading strategies. By focusing on capturing larger price swings, swing traders can filter out market noise and focus on high-probability trades.

Secondly, swing trading provides traders with the opportunity to take advantage of trend reversals. By identifying key support and resistance levels or other technical indicators, swing traders can enter positions at the beginning of a new trend, maximizing their profit potential.

Lastly, swing trading allows traders to adopt a more relaxed and flexible trading approach. Unlike day trading, which requires constant monitoring of the markets, swing trading allows traders to set their entry and exit levels and check in on their positions periodically.

Four Different Swing Trading Strategies

Now that we’ve covered the basics and advantages of swing trading, let’s explore four different swing trading strategies that you can incorporate into your trading arsenal.

Strategy 1: Fibonacci Retracement Levels

Fibonacci retracement levels are a popular tool in technical analysis, used to identify potential support and resistance levels. This strategy involves identifying a significant price move and then using Fibonacci ratios to determine potential retracement levels where the price is likely to reverse and continue its original trend.

To apply this strategy, first, identify a significant price move, either an uptrend or a downtrend. Then, use the Fibonacci retracement tool to draw retracement levels on your chart. The most commonly used Fibonacci ratios are 50%, 61.8%, and 127%. Look for prices to reverse or bounce off these levels, indicating a potential entry point.

How to Implement:

- Identify a trend: Look for a strong price trend in either direction.

- Plot Fibonacci retracement levels: From the swing low to the swing high in an uptrend, or from the swing high to the swing low in a downtrend.

- Entry signal: Look for the price to retrace to the Fibonacci levels (e.g., 50%, or 61.8%) and show signs of a reversal to enter a trade. The signs can be a wick of rejection, a bearish/bullish engulfing candlesticks pattern, or any reversal candlesticks pattern.

- Risk management: Set stop-loss orders below the recent swing low for long trades and above the recent swing high for short trades.

Example: In an uptrend, if the price retraces to the 61.8% Fibonacci level and shows signs of a bounce, traders can consider entering a long position with a stop-loss order below the recent swing low.

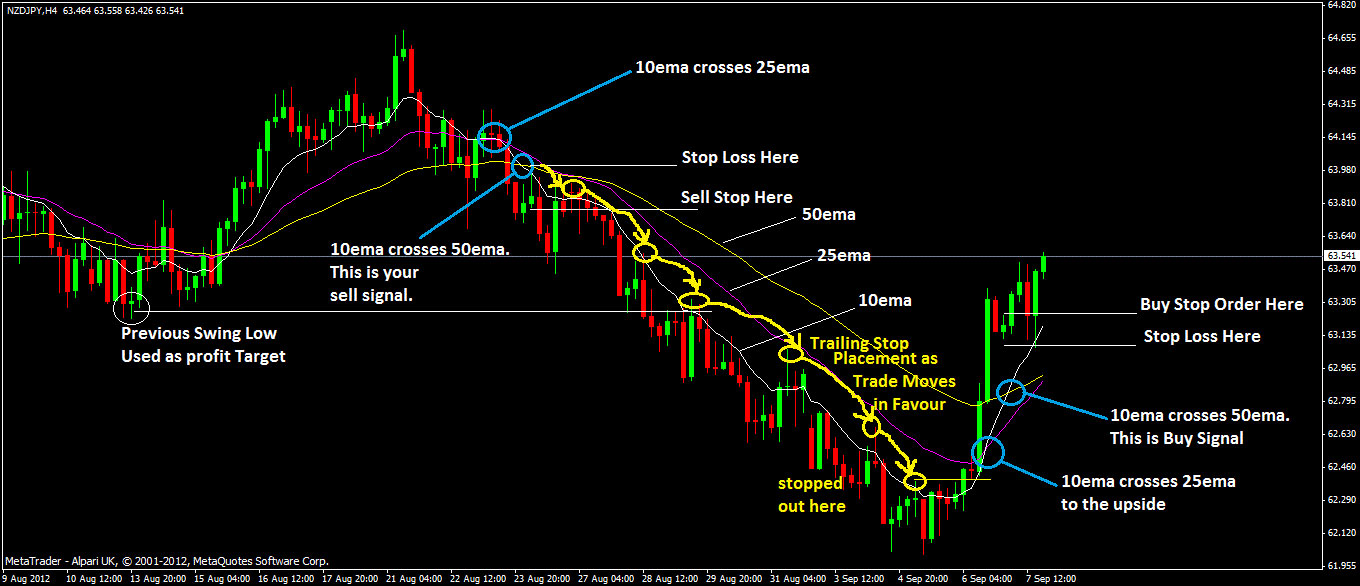

Strategy 2: Moving Averages Crossover or Moving Average Support Resistance

Moving averages are widely used by traders to identify trend direction or changes and potential entry and exit points. This strategy involves using two moving averages, one short-term and one long-term, and looking for a crossover signal.

To apply this strategy, select a short-term moving average, such as the 20-day moving average, and a long-term moving average, such as the 50-day moving average. When the short-term moving average crosses above the long-term moving average, it generates a buy signal. Vice Versa, when the short-term moving average crosses below the long-term moving average, it generates a sell signal. Or…

The basic swing trading strategies include 5ema and 8ema, 10 and 20 SMA, 50ema, and daily chart forex. Later, you can increase your skill to the next level by learning about simple swing forex strategy. Just like the name of the strategies, it means you can learn something simple there, especially about trading forex. The strategies also include several parameters. Those important parts are 3emas forex, Bollinger band forex, Bollinger band squeeze forex, horizontal channel pattern, three white soldiers, and many more.

How to Implement:

- Choose two moving averages: For example, a 50-period and a 200-period moving average.

- Entry signal: When the shorter-term moving average crosses above the longer-term moving average, it can signal a potential uptrend. Conversely, a crossover where the shorter-term moving average crosses below the longer-term moving average can signal a potential downtrend.

- Risk management: Set stop-loss orders to manage potential losses and take-profit levels to secure profits.

Example: If the 50-period moving average crosses above the 200-period moving average, it may signal a potential uptrend. Traders can consider entering a long position at this point.

In this case, you can learn specific things such as 34 moving average and 200 EMA, head and shoulder pattern forex, double bottom forex, and many others. You can learn about support resistance levels as an entry zone for opening positions as basic trading techniques.

Strategy 3: Bollinger Bands Breakout

Bollinger Bands are a volatility indicator that consists of a middle band, an upper band, and a lower band. This strategy focuses on trading near the bands to capture potential price reversals or breakouts.

How to Implement:

- Identify price near the bands: When the price touches the upper band, it may signal overbought conditions, while touching the lower band may signal oversold conditions.

- Entry signal: Look for reversal candlestick patterns or chart patterns near the bands to enter a trade.

- Risk management: Place stop-loss orders to manage risk and aim for a target based on the price reaching the opposite band.

Example: If the price touches the lower Bollinger Band and shows signs of reversal, traders can consider entering a long position with a stop-loss order below the recent swing low.

To apply this strategy, wait for the price to move towards the upper or lower band of the Bollinger Bands. When the price breaks above the upper band, it generates a buy signal. Conversely, when the price breaks below the lower band, it generates a sell signal. This strategy works well in markets that are trending or experiencing periods of consolidation.

Strategy 4: Price Action Reversal Patterns

Price action reversal patterns are powerful tools used by swing traders to identify potential trend reversals. These patterns are formed by a combination of candlestick formations, support and resistance levels, and other technical indicators. This strategy focuses on analyzing raw price movement without the use of indicators.

How to Implement:

- Identify key support and resistance levels: Use historical price data to identify areas where the price has reversed in the past.

- Entry signal: Look for price action signals such as pin bars, engulfing patterns, or inside bars near these levels to enter a trade.

- Risk management: Place stop-loss orders below support levels for long trades and above resistance levels for short trades.

Example: If the price forms a bullish pin bar at a strong support level, traders can consider entering a long position with a stop-loss order below the low of the pin bar.

To apply this strategy, familiarize yourself with popular price action reversal patterns such as double tops and bottoms, head and shoulders, and bullish or bearish engulfing patterns. Look for these patterns forming at key support or resistance levels, as they indicate a potential reversal in the current trend. Besides we must also understand too about liquidity zones that are usually fulfilled first before reversal movement happens.

Also Read Article :

Also Read Article :

Conclusion: Choosing the Right Strategy for Your Trading Style

As a forex swing trader, it’s important to understand that no single strategy will work perfectly in all market conditions. Each strategy has its strengths and weaknesses, and it’s up to you to choose the one that aligns with your trading style, risk tolerance, and market conditions.

If you want to increase your level as a trader, you also need to learn about advanced best forex indicators for swing trading. It is a hard one but it gives you logical knowledge about forex trading. Don’t forget to learn more about the best of the best swing forex trading strategy using support resistance trading strategy and candlestick reversal patterns to get accurate forex signals to understand how swing forex strategy works.

By mastering these swing trading strategies, you’ll have the knowledge and confidence to make informed trading decisions and potentially boost your profits in the forex market. Remember to backtest your strategies, apply proper risk management, and continuously adapt and refine your approach based on market feedback.

So, dive into the exciting world of swing trading, experiment with different strategies, and find the ones that work best for you. With patience, practice, and the right mindset, swing trading can become a valuable tool in your forex trading journey. Happy trading!