What are the best benchmarks to get the best forex trading platform and what are the types?

Determining the profitability of the forex trading platforms you are considering is the next step. Real-time demonstrations are provided, so make use of them. Go through the entire system and explore the platform from top to bottom. This can help you understand the system and its capabilities, find out how profitable the trading platform is, familiarize yourself with the platform, and at the same time allow you to have a general idea of how to make the platform work optimally for your trading style.

Having a good foreign exchange trading platform and knowing how to use it can create a major difference in your profit margin.

As the trading platform is the backbone of the forex trading activities of any forex broker, it is one of the most important factors to consider when you wish to start a trading account with a broker. The best platforms generally deal in American Dollars, British Pounds, Canadian Dollar, Euros, Swiss Francs, Australian Dollar, and Yen. You also will not have any commission fees or transaction fees.

The best online Forex trading platforms also highlight the ease of usage and clearness of the information. The platforms will also be easy to understand. They will also be able to be used on more than one computer. Many offer software downloads and can only be used on the computer on which the software is installed.

Regardless of whether you are just beginning to trade and are looking around for a suitable forex trading platform, or whether you are already trading, but would like to review the suitability of the trading platform, here are 6 selection parameters that can be used to determine the suitability of the forex trading platform.

1. Timeliness – Is the forex trading platform a high-edge system that employs established but highly sophisticated technologies to provide you the real-time, up-to-date quotes? This is very important, as a real-time streaming quote platform will allow you to check your account and positions in real-time, and more importantly, 24 hours a day, as forex trading never ceases. With real-time information via the trading platform, you as a trader can be in full control of your funds whenever you wish.

Some brokers also slow the execution of the orders. This is really a big issue as this will impact negatively your trades because the rate of the currency pair would change during this period of time, causing you to enter the market at a different rate than the rate you wanted.

2. Easy to Use software- Preferably, no software download. Look for a platform that enables users to start deals immediately, without the need to download proprietary software, or to spend weeks learning how to use an unwieldy possibly outdated system. You should not have to install any software on your own computer, and you should be able to log in from any computer that has an internet connection. There are also desktop solutions or trading platforms, but unless they allow you real-time information and the ability to be in control of your trades, they are not desirable.

3. Trading Rates – Some preferred trading platforms have a freeze and trade system involving a “freeze-the-rate you see” for buying and selling for a few seconds, irrespective of rate movement. This means that the rate you see and freeze is the rate you get, and no lag can cause you to lose out due to fluctuations and lapse of even a few seconds.

4. Easy Money Deposits – Are there easy mechanisms for payment of money deposits into your account and are these immediately reflected in your trading account? Some preferred trading platforms allow you the possibility to make money deposits for margins and pay premiums using a credit card, so that you are not hindered from making physical deposits, or have to attend to make deposits at your local bank. This is a real-time saver and allows you to trade immediately without delay after a deposit or payment has been made.

5. Competitive Spreads: Currencies, unlike futures and stocks, are not traded through a central exchange. Thus, the spread can be different depending on the broker.

Some brokers adopt a variable spread, which might appear to be nice and small when the market is quiet, but when things get busy they can widen the spread which means the market must move more in your favor before you start to make a profit. This makes it harder for you to be in profit. So always check this out before selecting such a trading platform and broker. Fixed spreads built into the trading platform is good for you especially if you are using stop loss in your trading strategy because if the broker changes the spread according to prevailing market conditions, you may find your trades hitting their stop levels where they should not!

6. Technical Support- The forex market is a 24-hour market, and your broker should provide 24-hour support for the use of their trading platform. Ask questions about their support because some brokers may not give equal support to retail clients as compared to institutional clients.

As you go over this checklist of parameters above, always bear in mind the broker and the trading platform should assist you in eliminating or reducing the risk of trading while allowing you to maintain control over your funds in real time. Spend time to check your trading platform to be used, and you will not regret it later.

Several Types of The Best Forex Trading Platforms And Their Advantages

When comparing different forex trading platforms, it’s essential to consider the unique features, functionalities, and advantages of each platform. Here’s a detailed comparison focusing on the cTrader trading platform, MetaTrader 4, MetaTrader 5, Forex Copy Trading Platform, and Autochartist:

cTrader Trading Platform

cTrader Tutorial, How to Start cTrader, cTrader vs MT4/MT5

- Versatility and Customization: cTrader provides a versatile trading experience with advanced charting tools, detailed pricing, and quick trading entry and execution. Traders can personalize the platform to match their unique trading style and preferences, including the ability to design trading robots and indicators. A stunning user interface, connected to the most sophisticated backend technology. cTrader trading platforms give you all the tools you’ll need for effective technical analysis, including common trend indicators, oscillators, volatility measures, and line drawings, all accessible from directly within the chart. There are 4 versions of the very popular cTrader trading platform and ICMARKETS offers all four versions of cTrader, namely cTrader Desktop, cTrader WebTrader, cTrader for iPhone, and cTrader for Android.

- Market Analysis and Research Tools: cTrader offers Market in View for real-time market direction and AutoChartist for trading ideas and strategy set-ups. It also provides access to Level II pricing, nine chart views, over 70 technical indicators, and depth of market data.

- ECN Trading Platform: cTrader is an ECN trading platform with fast order execution, nine order types, volume tooltips, and market sentiment indicators. It supports social trading through cTrader Copy, making it a robust competitor to MT4 and MT5. cTrader offers ultra-fast order execution. cTrader desktop and web-based has a user-friendly platform allowing you to enjoy Raw Pricing trading with No Dealing Desk trading from anywhere in the world.

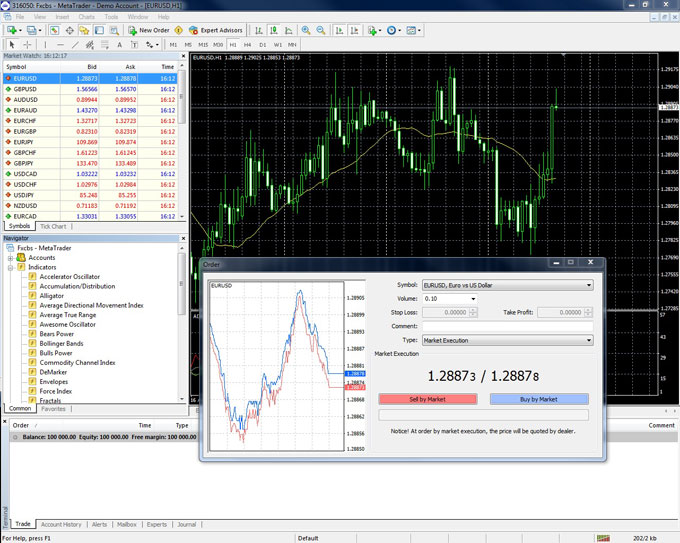

MetaTrader 4 (MT4)

- User-Friendly Interface: MT4 is known for its user-friendly interface, offering one-click trading, advanced charting, technical analysis, algorithmic trading capabilities, and the ability to create custom indicators and automated trading strategies using forex expert advisors known as forex robots with mql4. MetaTrader 4 also provides access to social trading support via the MQL5 community.

- Technical Analysis: MT4 provides a wide range of technical analysis tools, including trendlines, indicators, and charting strategies. It allows precise placement of charting elements and supports manual trading with data entry fields.

MetaTrader 5 (MT5)

- Advanced Trading Features: MT5 offers additional features compared to MT4, including more timeframes, economic calendar integration, more advanced charting, more order types, more technical indicators, and improved strategy tester. It also supports algorithmic trading capabilities and provides access to social trading support via the MQL5 community.

- Hedging and Netting: MT5 supports both hedging and netting, making it suitable for different trading strategies and styles.

Forex Copy Trading Platform

-

- Social Trading: Forex Copy Trading Platform allows traders to copy the trades of other successful traders, allowing less-experienced traders to benefit from the expertise of others. It offers customizable risk management tools, real-time trade copying, and a user-friendly interface. Forex Copy Trading Platform also provides access to a community of successful traders that traders can follow and learn from.

- Risk Management: Copy trading platforms often include risk management tools, such as the ability to set maximum allocation percentages and stop-loss orders. And everything happens in real-time conditions.

Autochartist

- Technical Analysis and Trading Ideas: Autochartist provides access to trading ideas and strategy set-ups, helping traders identify potential trade opportunities based on technical analysis. Autochartist provides traders with real-time market analysis and trading signals. It uses advanced algorithms to identify potential trading opportunities and provides traders with alerts when these opportunities arise. Autochartist also offers a range of customization options and supports multiple trading platforms, including MetaTrader 4 and MetaTrader 5.

- Enhanced Functionality: The platform allows traders to set stop-loss and limit-order levels by dragging the mouse across the price chart, streamlining the trade management process.

In summary, each forex trading platform offers unique features and advantages. cTrader stands out for its versatility, customization options, ECN trading environment, and advanced research tools. MetaTrader 4 and MetaTrader 5 are known for their user-friendly interfaces, comprehensive technical analysis tools, and automated trading capabilities. Forex copy trading platforms facilitate social trading and risk management, while Autochartist enhances technical analysis and trade idea generation. Depending on individual trading preferences and requirements, traders can choose the platform that best aligns with their trading goals and strategies.

A Complete Guide to Start with RoboForex Copy Trading & MetaTrader 4!

By choosing the best online forex trading platform for you, you will be able to take advantage of any market conditions and therefore make a profit by acting on the information given to you. This will help you to maximize the profits available to you. This information is priceless.

After several years of trading forex, I was somewhat curious about the forex copy trading platform offered by ROBOFOREX, and it turns out that after I tried some of the tops recommended traders from the list of available traders, I gained profits from forex trading just by following and copying their trades. After observing ROBOFOREX over the years in the forex trading world, ROBOFOREX has consistently provided its best innovations throughout the development journey of the international-class forex brokerage company. In my opinion, ROBOFOREX is one of the best forex brokers, and for all fellow traders, do not hesitate to join the forex copy trading platform that ROBOFOREX offers because it is indeed very worthwhile. The second choice for forex copy trading platforms is HFM or HotForex Copy Trades.

My Forex Copy List Traders Recommendation: NickSm Trader, DLONGTRADING Trader, XtradeInvestment Trader, Kagul Trader, WiseTrader Trader

By understanding the platform and the information contained within you will be able to make decisions in regards to the buying and selling of the currency that you have chosen. By knowing all the information that is available to you, you will be in a position to capitalize on any market change. But, until this time best forex trading platforms for me are still cTrader Desktop and Metatrader 4, but you can choose as you like.