Stop Loss Forex Basics Strategy

There are some stop-loss strategies to apply when we want our money safe and to stay away from danger. There are also some strategies to manage the existing risks so that we can get our maximum profit from our trading. Using our forex strategies means we have to stick to the rules that our strategies have set. Without enough discipline, we would perhaps mess our money up.

There are some stop-loss strategies to apply when we want our money safe and to stay away from danger. There are also some strategies to manage the existing risks so that we can get our maximum profit from our trading. Using our forex strategies means we have to stick to the rules that our strategies have set. Without enough discipline, we would perhaps mess our money up.

Stop loss definition is the lowest price limit values specified to limit losses. When the price action touches this value, then the system will automatically close the order or position.

The decision to put a stop loss is optional, some forex traders are comfortable with this stop loss strategy but on the other side, most traders are not comfortable with stop loss because some brokers can hunt stop loss to our stop loss price level that we set before. In the end, this decision about setting our stop loss depends on our trading strategies itself.

Stop Loss Forex Basics Strategy

To give more protection to our money we should use more strategies. The stop-loss strategies enable us to prevent us from too much danger of losing our money. To implement the stop-loss strategies we need to set what amount of money we are willing to give when our trading does not run smoothly.

The effective way is by using trailing stops strategies. To use the current strategies we just need to set up the percentage we are willing to spend when we have the situation of loss. In other words, the nature of forex trading itself is how we measure our risk of losing money. When our trading does not work well we could also make our strategies to lock our gain.

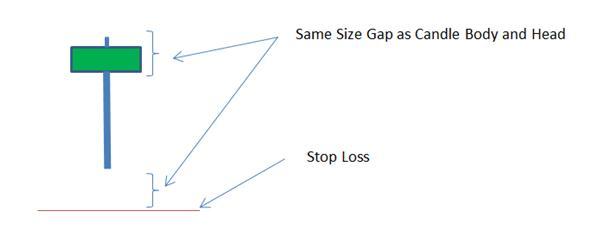

Let’s learn more about this stop-loss strategy based on candlestick basics and pin bar by seeing this picture below :

|

|

|

|

Here again how to set price of stop loss strategies on our MetaTrader interface :

Conclusion

Every forex trader has their characteristics in determining the key level of a stop loss. Some traders use tight money management based on risk percent and in good money management don’t ever risk our equity to exceed 5%.

Also, some veteran forex traders never use a stop loss level, usually, they use an averaging martingale trading strategy, and even if they use a stop loss strategy they set their stop loss based four hour or daily time frame based long tail candlestick and adding with some pips like picture above.

Also, some veteran forex traders never use a stop loss level, usually, they use an averaging martingale trading strategy, and even if they use a stop loss strategy they set their stop loss based four hour or daily time frame based long tail candlestick and adding with some pips like picture above.

In other forex traders communities, some forex traders only use stop loss level-based technical analysis via indicators or even only with naked charts. Of course, it takes skill and experience to analyze the charts. This is the way I like it, usually, I put my stop loss level based on support resistance which price level has been tested and retested at least three times. This key level is strong support resistance. So at this support resistance key level, we can add 3 or 5 pips more on the highest or lowest wick as our stop loss price level. Don’t forget to use this stop-loss strategy for at least an hour time frame and happy practice with top-rated forex brokers that we’ve tested these forex brokers have good reviews and for sure these forex brokers do not cheat like hunting our stop-loss, so try it.