The Sandwich Trading Setup

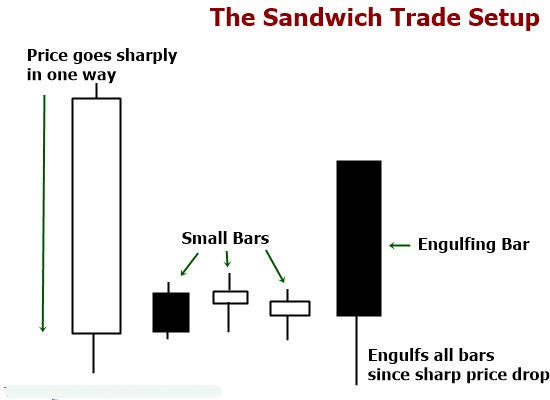

The Sandwich Trading setup is a trading pattern that I love and this is my favorite trading setup. This sandwich trading setup is very effectively. There are some other trade patterns sort of similar to this but there is no one that trades this exact setup. I have found this to be a very reliable and profitable trade setup.Ok let’s get into the details, the Sandwich Trading is made up of multiple candles and involves an engulfing bar. It forms by the market going up or down sharply then having multiple small bars follow it. Then after those small bars a bigger bar engulfs the previous small bars. This essentially forms a sandwich and you will get a better idea of what it looks like as the article goes on.

It can act as a reversal signal or a continuation signal depending on whether the 2nd big bar is bullish or bearish.

What a Sandwich Trading Looks Like

The diagram below shows a bullish Sandwich Trading, notice how the price drops sharply down then it is followed by a couple small bars. Then an engulfing bar consumes all of the small bars since the sharp price drop. This is a simple example of a Sandwich Trading.

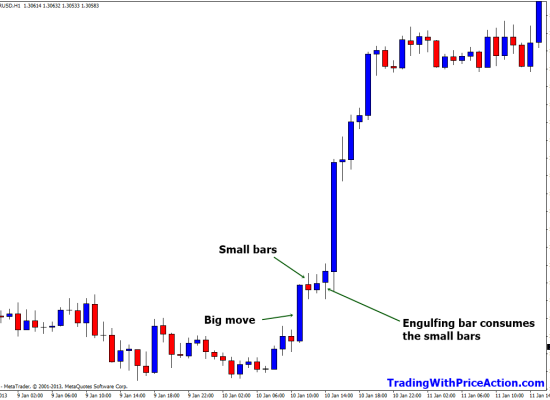

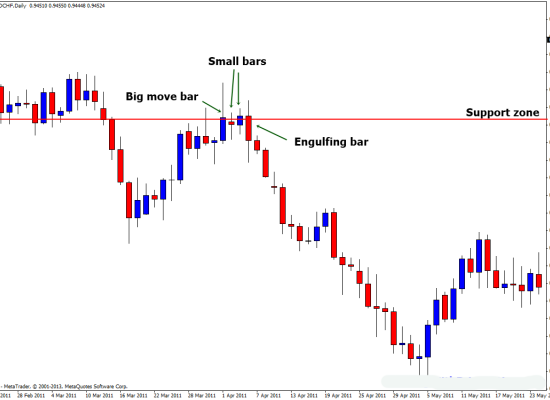

On this chart you get to see what a Sandwich Trading looks like on a real chart. Notice how there is a big move up, then some small bars and then an engulfing bar. Perfect setup for the Sandwich Trading, then the price rockets up after.

Characteristics of a Sandwich Trading

- This sandwich trading setup it should be on strong support or resistance or at least a minor support resistance

- The “big move” bar has to be bigger than the previous candle to be considered a big move

- The bodies of the small bars can’t be bigger than 1/2 of the big move bar, the smaller the better

- The small bars wicks don’t matter, the smaller the better

- The engulfing bar must consume all the small bars

- At least one small bar between the big move bar and the engulfing bar, the more small bars there are the better

How to Trade the Sandwich Trading Setup

Just like with any trade setup that forms, the best way to trade them is if they are on a strong support or resistance zone and with the overall trend. The same goes for the Sandwich Trading setup. By having the trade setup form on a strong support or resistance zone and with the overall trend of the market you are increasing the odds of a successful trade.

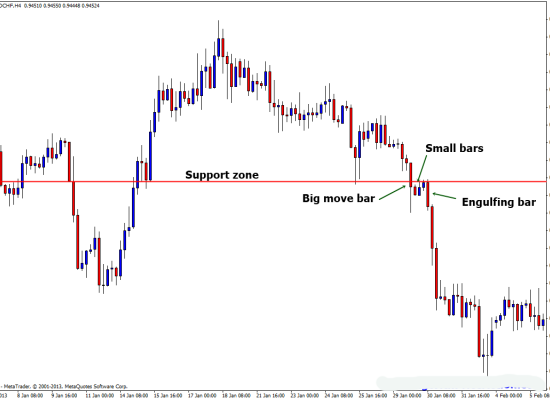

Let’s take a look at a Sandwich Trading setup that has formed on a support or resistance zone along with going with the overall trend:

With the chart below you can see that the market is trending down and the Sandwich Trading formed right on a resistance zone. The big move bar pierced the support zone then the market stalled with the small bars. Then the engulfing bar consumed the small bars and formed right on the broken support zone.

Sandwich Trade With Support

A Sandwich Trading setup can either act as a reversal pattern or a continuation pattern depending on where it forms. Let’s take a look at a reversal setup and a continuation pattern:

This chart below you can see that the Sandwich Trading setup is a reversal setup. See how there was a small uptrend starting but then a Sandwich Trading setup formed at a resistance zone and the price reversed. This is a good example of a reversal setup.

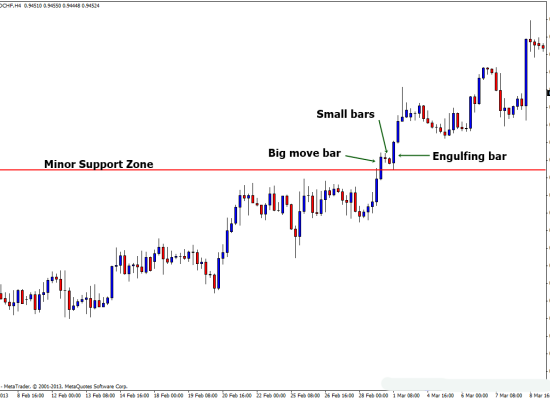

This chart is a great example of a continuation setup. The reason that this is a continuation pattern is because it is in an uptrend, the sandwich setup gives you a way to enter the trend on a pullback. One way to identify that it is a continuation pattern is for the big move bar to break through a support or resistance zone then have the small bars pullback and sit right on the support or resistance zone. Then have the engulfing bar form and consume the small bars. The chart of USDCHF below did just happened.

Entry and Stop Loss Placements for a Sandwich Trading

Having the proper placement for the entry and stop loss is very important when trading. Setting up the entry and the stop loss incorrectly could lead to bad trades and poorly managed trades also. Getting the right entry and stop loss placement is vital to a successful trade.

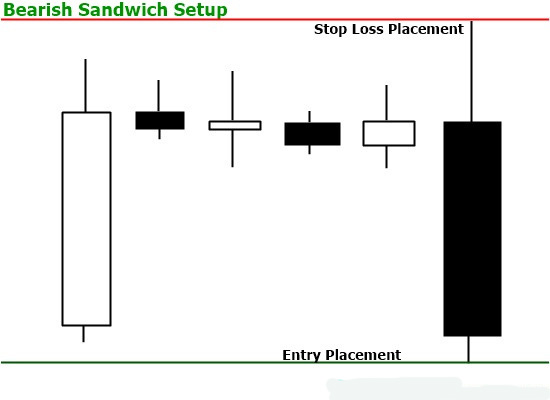

The entry for a Sandwich Trading is very simple, for a bullish setup you will place the entry on the high of the engulfing bar. For a bearish setup you will place the entry on the low of the engulfing bar, just like a normal engulfing bar.

The diagram below shows where to place the entry and stop loss for a bearish Sandwich Trading setup

Conclusion

The Sandwich Trading setup is a very solid trading pattern to and learning how to trade it will help you as a trader. This setup does not happen as much as other trading setups such as the pin bar or the engulfing bar but when it does form it is a very powerful setup. And never give up on learning how to read chart pattern using price action on changing trend more faster so then we can get reversal momentum. I hope this article about price action sandwich trading setup can make us as a traders more careful on seeing market will continue or reversal from main trend.

At last, be wise with lot management and best part you can try your strategy in cents account with ROBOFOREX PRO CENTS Account.